This post was originally published on this site.

In This Article

Everyone thought the Bitcoin price would “moon shoot” in Q4 2025. It didn’t. For the first time in a very long time, BTC USD prices closed the quarter in red. While there have been positive developments since then, nothing has yet emerged to save the bulls by pushing “digital gold” above the elusive $100,000 mark.

Instead, geopolitical tension has exacerbated market anxiety. Following President Trump’s comments regarding Greenland roughly 10 days ago, the Bitcoin price tanked toward $87,000 before bouncing back to current spot rates. Meanwhile, gold and precious metals are on a historic tear. For the first time, the yellow metal soared above $5,100 before retracing.

Crypto Fear and Greed Chart

All time

1y

1m

1w

24h

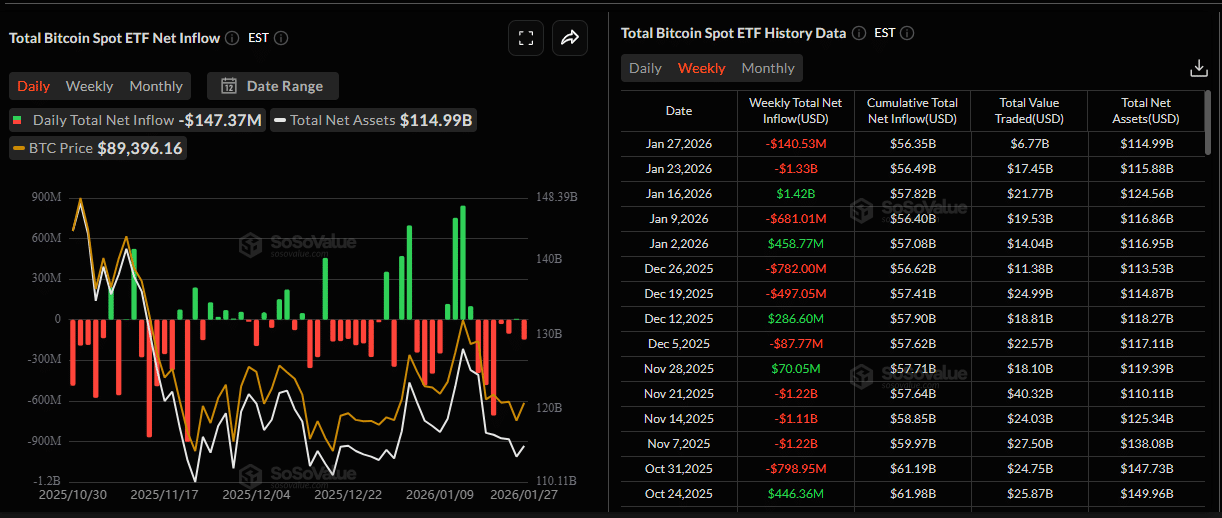

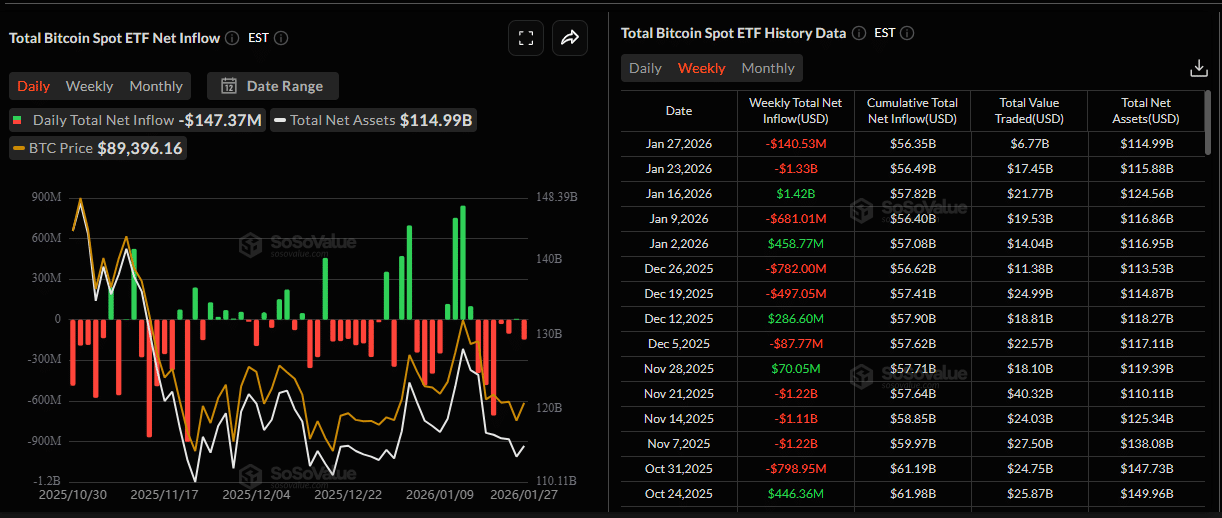

Amid this, institutions were scrambling for the exits, dumping spot Bitcoin ETFs. Last week, over $1.3Bn were redeemed, worsening crypto sentiment. Now, investors are cautious, waiting for confirmation on whether the Bitcoin price will extend losses, breaking below $87,000, and prolonging its “coma”, or recover and surprise critics.

DISCOVER: 9+ Best Memecoin to Buy in 2026

Haters Should Chill, The Bitcoin Price Could Recover

Among those who are optimistic, laying out solid numbers to support a Bitcoin bull run in 2026 is Eric Balchunas, a renowned ETF analyst. In a post on X, he said the current sense of dread permeating the Bitcoin community is short-sighted.

The dread I see from bitcoiners (and the football spiking from the haters) is very short-sighted to me given that since 2022 (right before the BlackRock ETF filing) Bitcoin is up 429%, gold 177%, Silver 350%, QQQ 140%. In other words bitcoin spanked everything so bad in ’23 and… pic.twitter.com/SPNB9RTdzv

— Eric Balchunas (@EricBalchunas) January 27, 2026

To understand his point of view, he said critics should look at the Bitcoin scoreboard since the extended winter of 2022. After BTC USD prices sank to as low as $15,800, dragging even the best cryptos to buy with it, the coin has not only recovered, but has outperformed gold, precious metals, and even top stocks.

Beyond the bounce, the approval of spot Bitcoin ETFs proved to be a game-changer. Since that pivot in early 2024, the Bitcoin price has been on a tear, adding nearly +430%. During that time, gold, though dominating headlines, only rose by +177%. Meanwhile, silver added +350% while the tech-heavy QQQ index only saw a +140% change.

In short, though the Bitcoin price is range-bound, it has been outperforming every major asset class in the last three years. Gold and Silver, while in the spotlight, are still struggling to catch up, but BTC USD is in a plateau.

This sideways chop, a “coma” of sorts, the ETF analyst said, is not a sign of failure. Instead, in his view, it is a structural breather as Bitcoin and crypto as a whole wait for institutions to catch up.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

Will BTC USD Move Higher Today After The First Fed Meeting In 2026?

The good news is that institutional confidence is back. Unlike last week when over $1.3Bn of spot Bitcoin ETFs were redeemed, outflows have drastically slowed down this week. So far, institutions have sold $140M of spot Bitcoin ETF shares. Unless there is an unexpected dip, outflows will likely reduce by the end of the week, especially if the Fed becomes dovish today.

(Source: SosoValue)

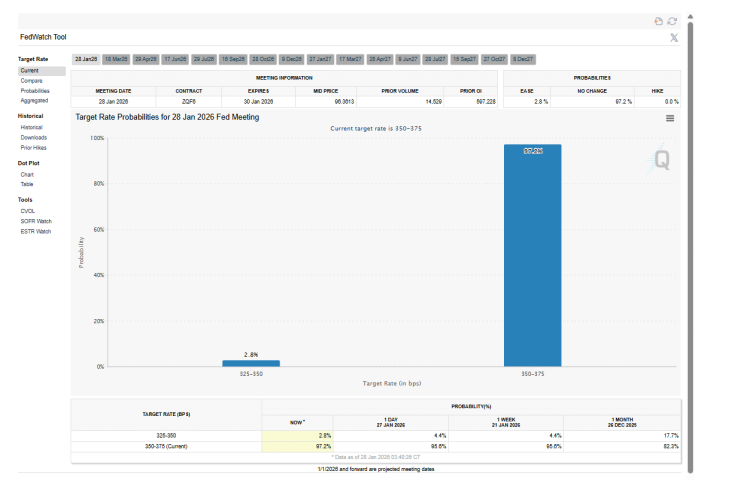

Trackers show that the Fed will likely hold interest rates within the +3.5% to +3.75% range. The central bank has been on a rate-cutting spree, slashing rates for three consecutive meetings in late 2025. Overall, the Fed will be keen on ensuring labor market conditions remain strong and inflation drops toward the +2% benchmark. For now, the US labor market is cooling, but inflation remains “sticky”, which gives the Fed a reason to pause and observe how the previous cuts are filtering through the economy.

(Source: CME FedTool)

If Jerome Powell, the Fed chair, emphasizes that inflation is still too high, risk assets, including Bitcoin and top Solana meme coins, could tumble as hopes of a Q1 2026 rate cut fade. Overall, the markets expect the central bank to slash rates once or twice in 2026. If this changes, and the Fed says they will consider increasing rate cuts, the Bitcoin price will likely tick higher.

[embedded content]

[embedded content]

This is worth noting because the Fed is facing immense pressure from the Trump administration to cut rates aggressively. It remains to be seen whether Chair Powell will also use the presser to defend their independence after recent DoJ investigations.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!