This post was originally published on this site.

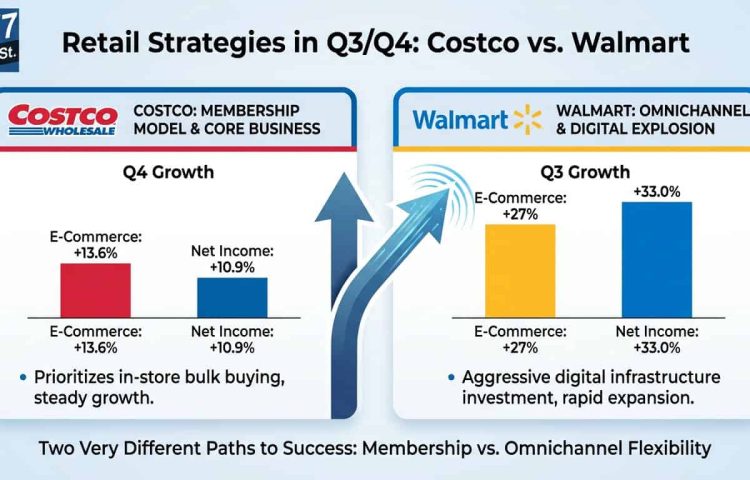

Costco Wholesale Corporation (NASDAQ: COST) and Walmart Inc. (NYSE: WMT) both closed out strong quarters recently, revealing two very different strategies for winning in retail. Costco leaned into its membership warehouse model with e-commerce expansion. Walmart went all-in on omnichannel transformation and marketplace growth.

E-Commerce Growth Tells Two Different Stories

Walmart’s digital business exploded 27% in Q3, driven by store-fulfilled delivery, marketplace expansion, and aggressive investments in digital infrastructure. The company spent $18.6 billion on capital expenditures this year, much aimed at logistics and technology supporting same-day delivery and pickup. CFO John David Rainey emphasized “enhancing the digital customer experience” during the earnings call.

Costco’s e-commerce grew 13.6% in Q4, solid but far slower than Walmart’s pace. The company operates 914 warehouses globally and continues prioritizing the in-store bulk buying experience that defines its model. E-commerce supports the core business rather than transforming it. Comparable sales rose across all regions.

Walmart’s international segment jumped 10.8% to $33.5 billion in net sales, while Sam’s Club added $23.6 billion with 3.1% growth. The breadth of Walmart’s portfolio gives it more levers to pull when one segment softens.

Membership Model vs. Omnichannel Flexibility

Costco’s strategy revolves around membership fees and bulk purchasing. The model creates predictable revenue and keeps customers locked into the ecosystem. Net income grew 10.9% to $2.61 billion, and profit margin held at 2.94%. Operating margin of 3.88% reflects the thin-margin, high-volume approach that has worked for decades.

Walmart’s net income surged 33.0% to $6.09 billion, though operating income stayed flat due to share-based compensation charges related to PhonePe. The company raised full-year guidance to adjusted EPS of $2.58 to $2.63. Gross margin grew slower than revenue, indicating pricing pressure, but scale and diversification provide cushion.

| Metric | Costco | Walmart |

| E-Commerce Growth | 13.6% | 27% |

| Net Income Growth | 10.9% | 33.0% |

| Operating Margin | 3.88% | 3.73% |

| P/E Ratio | 49.02 | 40.39 |

Walmart’s marketplace and digital infrastructure give it flexibility Costco doesn’t have. Costco’s warehouse model limits how fast it can scale and where it can compete. But that constraint also creates discipline.

What I’m Watching Into 2026

I will be watching whether Walmart can sustain 27% e-commerce growth without crushing margins further. The capital spending is massive, and the payoff needs to show up in profitability soon. Costco’s challenge: can it accelerate digital growth without diluting the membership value proposition?

Walmart’s international strength and Sam’s Club stability give it more ways to win if U.S. retail softens. Costco’s global footprint is solid but less diversified. Both companies face input cost volatility and consumer spending uncertainty heading into 2026.

Why I Lean Toward Walmart for Growth Investors

If you want a turnaround story with momentum, Walmart looks more compelling right now. The 33% net income growth and 27% e-commerce surge show the digital transformation is working. The stock trades at 40x earnings compared to Costco’s 49x, offering better value for the growth rate.

Costco fits defensive investors better. As one Reddit user put it: “For me, my best investment was probably Costco. I bought in March during that random dip and just held. Boring but solid.” That sums up the appeal. Steady, predictable, reliable.

Walmart may appeal more to investors focused on omnichannel retail growth and digital transformation. Costco may fit better for those prioritizing stability and the proven membership model during economic volatility.