This post was originally published on this site.

Bitcoin surged past $97,000 on Wednesday as the crypto finally caught up with a broader rally in equities and precious metals, with over $100 million in short positions liquidated in just one hour.

The breakout comes after weeks of Bitcoin lagging behind traditional assets, with QCP Capital noting that the digital asset has pushed through the $95,000 resistance level that capped rallies since November.

The move higher reflects a strengthening risk-on environment driven by stable U.S. inflation and a resilient job market, creating what QCP describes as a “Goldilocks environment” where investors are piling into everything from stocks to precious metals and now crypto.

Despite geopolitical tensions in Venezuela and Iran, markets have remained resilient, interpreting U.S. involvement as a reassertion of global leadership rather than a source of instability.

Trump’s Economic Agenda Fuels Market Confidence

QCP believes political calculations are driving the rally, arguing that President Trump is focused on achieving new equity market highs ahead of the midterm elections this year.

“The market is convinced that Trump will do anything to Make America Great Again, with his measure of success being new highs in equity markets,” QCP stated in its analysis.

The firm sees flush liquidity and renewed American leadership as Trump’s primary tools, naturally leading to U.S. outperformance and a global risk-on environment.

However, traditional markets showed cracks on Wednesday as Wall Street declined for a second straight session.

The S&P 500 fell 0.7%, while the Dow Jones Industrial Average dropped 182 points, weighed down by mixed bank earnings that disappointed investors.

Wells Fargo plunged 4.6% on weaker-than-expected revenue, while Bank of America declined 3.8% despite beating profit estimates, highlighting how elevated valuations have left little room for disappointment.

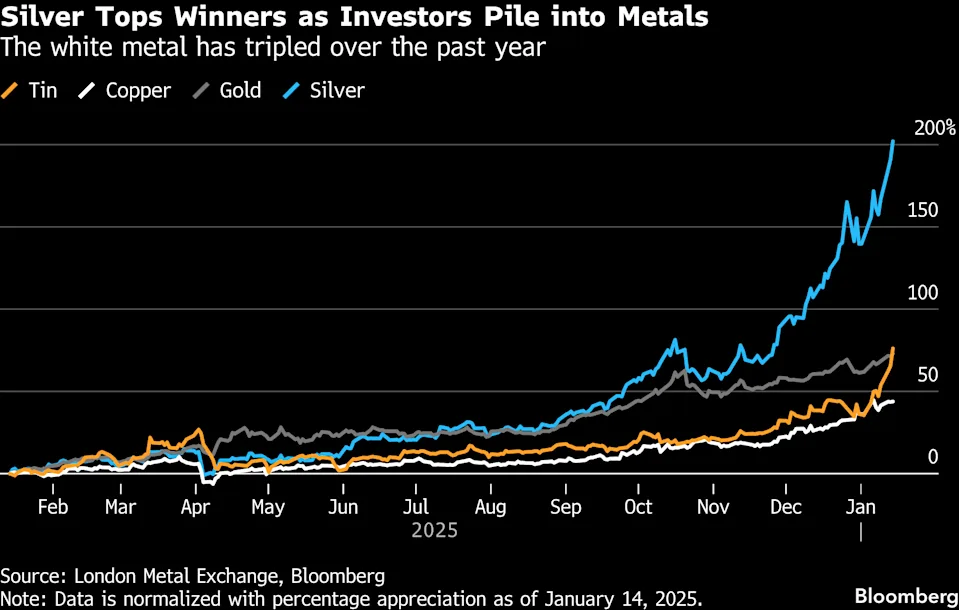

Meanwhile, precious metals continued their explosive start to the year, with gold, silver, copper, and tin all hitting record highs as investors embraced the so-called debasement trade.

Silver jumped 6.1% to top $92 per ounce, while gold notched another all-time peak above $4,620, capping a remarkable 65% gain in 2025.

“When gold moves first, it usually signals declining trust in fiat currencies,” Hao Hong, chief investment officer at Lotus Asset Management, told Bloomberg. “Everything is measured against gold, then most assets look cheap right now.“

Political Turmoil Amplifies Safe-Haven Demand

The precious metals rally accelerated after deadly protests in Iran killed over 500 people, with Tehran warning it could target U.S. military bases if President Trump intervenes.

Political uncertainty intensified when the Justice Department served Federal Reserve Chair Jerome Powell with grand jury subpoenas over Senate testimony, pressuring the dollar and raising questions about central bank independence.

Farzam Ehsani, CEO of crypto exchange VALR, warned that the situation creates a paradox for digital assets.

“On the one hand, weakening confidence in dollar policy traditionally increases interest in decentralized assets as a hedge against political and currency risk,” he said.

“On the other hand, abrupt political maneuvers and aggressive polarization within the government are increasing instability, triggering short-term outflows from risky assets.“

Ray Youssef, CEO of the crypto app NoOnes, also noted that capital rotation, rather than panic, appears to be driving market moves.

“The US market is slightly down, but this is more likely due to capital rotation, as investors are shifting capital from riskier to more predictable sectors,” he explained, adding that gold and Bitcoin are increasingly treated as refuges from macro chaos.

QCP sees Bitcoin’s recent underperformance relative to precious metals as creating opportunity, suggesting that “the relative cheapness of Bitcoin relative to precious metals at this point may spur a rotation to digital assets.”

The firm acknowledged risks remain, particularly around pending Supreme Court decisions on tariffs (which have also been delayed again), and potential escalation in Venezuela or Iran, but believes these concerns are already priced in.

Youssef remained cautious, noting that the crypto market “continues to see active BTC selling during the U.S. trading session” and that “no compelling reason yet for the cryptocurrency’s rapid price growth.“