This post was originally published on this site.

While interest rates remain at still relatively attractive levels, money market funds and money market ETFs continue to hold a special place in investment strategies. Long confined to a simple waiting solution, these low-risk investments allow you to put your savings to work without sacrificing the liquidity of your capital, provided you choose the instruments wisely.

To help you gain clarity, Café de la Bourse has selected and compared the best money market ETFs and funds for 2026, based on objective criteria to help you identify the most relevant money market funds.

What is the best money market fund 2026?

A money market fund is a low-risk investment that places capital in very short-term debt instruments (Treasury bills, debt securities, deposits). It can take the form of a money market ETF or a money market UCITS fund, and is primarily used to manage cash with liquidity and visibility.

How did Café de la Bourse carry out this comparison of money market funds 2026?

To establish this comparison of the best money market funds and ETFs for 2026, we deliberately distinguished two main categories of instruments:

- on one side the money market UCITS funds, more traditional investment funds,

- and on the other side the money market ETFs, which are index funds listed on the stock exchange, also known as “trackers.”

To guarantee a coherent and objective comparison, we nevertheless applied exactly the same analysis criteria to both categories.

Our selection thus rests on three essential pillars:

- the level of fees,

- the recent performance

- and the fund’s solidity, measured through its history and the amount of assets under management.

This methodology allowed us to arrive at a tight and representative selection, with a top 3 of the best money market ETFs and a top 3 of the best money market UCITS funds, for a total of six money market funds.

The best money market funds 2026: summary table

| Product type | Best on fees | Best on performance | Oldest & most solid |

| Money market ETF | BNP Paribas Easy EUR Overnight UCITS ETF | Amundi Smart Overnight Return UCITS ETF | Xtrackers II EUR Overnight Rate Swap UCITS ETF |

| Money market UCITS fund | Épargne Éthique Monétaire C | Hugau Monéterme I | Amundi Money Market Fund |

Top 3 best Money Market ETFs

1- The cheapest: BNP Paribas Easy EUR Overnight UCITS ETF

The BNP Paribas Easy EUR Overnight UCITS ETF stands out primarily for its very low management fees, at only 0.05% per year. In the money market ETF segment, where yields are inherently modest, the fee level plays a decisive role in net performance. This is why we have selected this ETF as the best on fees in our 2026 comparison.

Key characteristics of the BNP Paribas Easy EUR Overnight ETF

- ISIN / Ticker : LU3025345516 – CASHE

- Fees : 0.05% per year

- Accumulation : accumulating

- Replication : synthetic (swap)

- Assets under management : over €400 million

- Creation date : 17 June 2025

BNP Paribas Easy EUR Overnight Performance

2- The most performing: Amundi Smart Overnight Return UCITS ETF

In 2025, the Amundi Smart Overnight Return UCITS ETF posted a return of +2.55%, solid performance for a money market ETF in a context of slightly falling rates. Over a longer horizon, its cumulative performance reaches +10.23% over three years, illustrating its ability to effectively capture favorable phases in the money market.

It is precisely this regularity of performance, combined with a sufficiently long track record, that led us to designate this ETF as the best in its category in terms of performance in our 2026 comparison.

Key characteristics of the Amundi Smart Overnight Return

- ISIN / Ticker : LU1190417599 – CSH2

- Fees : 0.10% per year

- Accumulation : accumulating

- Replication : synthetic (swap)

- Assets under management : around €4.2 billion

- Creation date : 2 March 2015

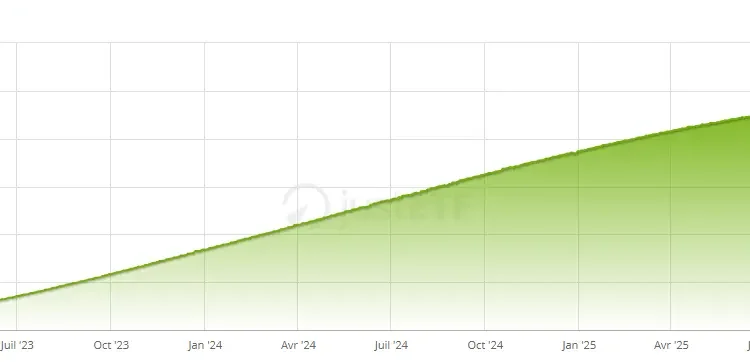

Performance Amundi Smart Overnight Return

3- The most solid: Xtrackers II EUR Overnight Rate Swap ETF

The Xtrackers II EUR Overnight Rate Swap UCITS ETF stands out above all for its exceptional size and very long history. With around €18.2 billion in assets under management, it is one of the largest money market ETFs available in Europe.

Created as early as May 2007, well before the widespread adoption of money market ETFs in Europe, it has weathered several rate cycles, making it a true benchmark in the segment. This is why we have chosen it as the oldest and most solid in our 2026 comparison.

Key characteristics of the Xtrackers II EUR Overnight Rate Swap

- ISIN / Ticker : LU0290358497 – XERS

- Fees : 0.10% per year

- Accumulation : accumulating

- Replication : synthetic (swap)

- Assets under management : around €18.2 billion

- Creation date : 25 May 2007

Performance Xtrackers II EUR Overnight Rate Swap

Top 3 best Money Market UCITS Funds

1- The cheapest: Épargne Éthique Monétaire C

Épargne Éthique Monétaire C stands out above all for its particularly low management fees for a money market UCITS, at 0.19% per year. By comparison, traditional money market UCITS typically charge between 0.25% and 0.40%.

This level of fees helps preserve more of the net return, which justifies its place as the best money market UCITS on fees in our selection.

Key characteristics of the Épargne Éthique Monétaire C fund

- Type : Money market UCITS

- Management : active

- Fees : 0.19% per year

- Specialty : ethical / responsible investing approach

2- The most performing: Hugau Monéterme I

Hugau Monéterme I stood out with performance higher than the average of money market UCITS in the recent period. Thanks to effective active management of the money market, this fund delivered a return of about 3% in 2025, versus around 2% to 2.5% on average for traditional money market funds.

It is this performance gap that led us to designate it as the best money market UCITS in terms of yield in our 2026 comparison.

Key characteristics of the Hugau Monéterme I fund

- Type : Money market UCITS

- Management : active

- Performance 2025 : ≈ 3%

- Positioning : seeking Euro money market yield

3- The most solid: Amundi Money Market Fund

Amundi Money Market Fund stands as a historic reference in the money market. Created in 2001, this fund benefits from a very long track record and assets under management exceeding €20 billion.

This combination of longevity, size, and liquidity explains why we have designated it as the most solid money market UCITS in our 2026 comparison.

Key characteristics of the Amundi Money Market Fund

- Type : Money market UCITS

- Management : active

- Assets under management : > €20 billion

- Creation date : 2001

Bonus: 2 Money Market ETFs eligible for the PEA

In our 2026 comparison of money market funds and ETFs, we chose to add two additional money market ETFs that present particular interest: they are eligible for the PEA, which is rare for money market ETFs, typically accessible from a standard securities account.

These are the following ETFs:

- Amundi PEA Euro Court Terme UCITS ETF Acc;

- BNP Paribas Easy EUR Overnight UCITS ETF Dist.

This eligibility is not due to their intrinsic nature but to a specific structuring and financial engineering that allows circumventing the PEA eligibility rules.

Their inclusion in our comparison is not part of the main ranking; it is a bonus for investors looking to invest in a money market fund through one of the best PEA vehicles to benefit from the tax advantages of this wrapper.

| Money market ETF PEA | ISIN / Ticker | Fees | Accumulation |

| Amundi PEA Euro Court Terme UCITS ETF Acc | FR0013346681 – OBLI | 0.25% p.a. | Accumulation |

| BNP Paribas Easy EUR Overnight UCITS ETF Dist | LU3025345789 – EDET | 0.05% p.a. | Distribution |

FAQ best money market fund 2026: everything you need to know to compare and choose a money market fund

In theory, a money market fund is designed to offer very high capital safety by investing in very short-term, high-quality debt instruments.

However, a marginal loss remains possible in the event of a sharp rise in rates, an exceptional default of an issuer, or overly high fees. In practice, these situations are rare and the fluctuations are very limited compared with other asset classes.

A money market fund is ideal for short-term investing, typically from a few weeks to a few months.

It can also serve as a waiting solution for capital intended to be reinvested later (in stocks, ETFs, real estate, etc.), or as a defensive building block in a broader allocation.

Returns mainly depend on money market interest rates:

- When central banks keep rates low, yields on very short-term instruments remain low.

- When they raise rates, money market funds quickly capture these increases.

Thus, a 10- or 20-year horizon encompasses very different phases, which explains the variation in results.

Over the past ten years, money market funds delivered an annualized average return between 1.5% and 2%.

However, this average masks wide disparities: years with nearly zero returns between 2015 and 2021 when rates were near 0%, followed by a pronounced rebound since 2022 with annual performances around 3% to 4%.

Concretely, €10,000 invested in a money market fund over 10 years would have yielded roughly €1,500 to €2,000 in interest, before taxes.

All of our information is, by nature, general. It does not take into account your personal situation and does not constitute personalized recommendations for making transactions, and cannot be equated to financial investment advice, nor to any encouragement to buy or sell financial instruments. The reader is solely responsible for using the information provided, and Cafedelabourse.com cannot be held liable. The publisher of Cafedelabourse.com cannot be held liable in any case for errors, omissions, or inappropriate investments.