This post was originally published on this site.

The trajectory of cryptocurrency in 2025 can be summarized in a single dramatic arc: triumph followed by humiliation. The year began with euphoria as Bitcoin surged over $109,350 on Trump’s inauguration day, driven by political tailwinds and promises of regulatory clarity. By October, however, the market had discovered a sobering truth – crypto had finally integrated into the broader financial system, but not in the way evangelists had envisioned.

Rather than becoming a refuge from macroeconomic turbulence, Bitcoin revealed itself as a high-beta risk asset, vulnerable to the same geopolitical shocks that roil traditional markets. This reckoning marks a fundamental inflection point: 2025 was the year cryptocurrency achieved institutional legitimacy while simultaneously losing its claim to exceptionalism.

Article contents

The “Uptober” Illusion and the October Rout

Throughout the first three quarters of 2025, cryptocurrency appeared poised for a historic bull market. Bitcoin methodically climbed through psychological barriers, breaking $100k in December 2024 and subsequently reaching $110k in May, $122,780 in July, and culminating in an all-time high of $126,000 on October 8.

The narrative was intoxicating: spot Bitcoin ETFs had attracted $13.5 billion in Q3 inflows alone, institutional adoption was accelerating, and the Trump administration had positioned itself as a champion of digital assets. Market participants who had endured the 2022-2023 bear market finally saw vindication. Then came October 10.

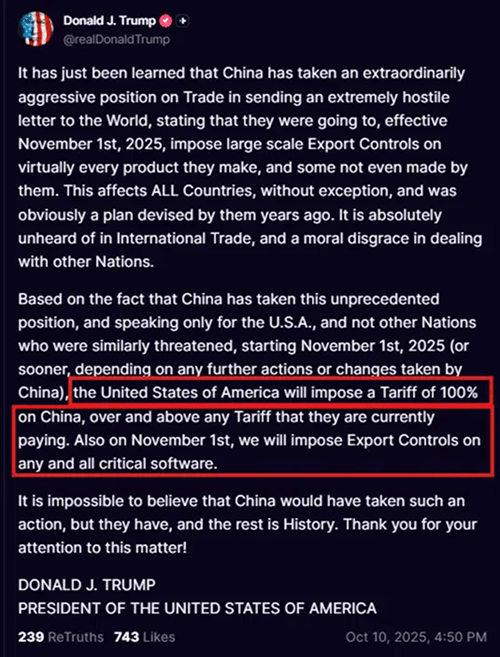

President Trump’s announcement of 100% tariffs on Chinese goods and export controls on “any and all critical software” in response to China’s rare earth export restrictions triggered an immediate violent repricing. Within 24 hours, Bitcoin plummeted from above $112,000 to $104,782—a 14% single-day decline that precipitated the largest deleveraging event in crypto history.

Over $19.13 billion in leveraged positions were liquidated across 1.6 million traders, and the total crypto market capitalization contracted by approximately $350 billion. Ethereum fell more steeply, dropping 20% to around $3,500.

The crash was not primarily a liquidity crisis or a technical breakdown—it was a category error. The market had priced crypto as a hedge against traditional financial volatility; the October event demonstrated the opposite. Bitcoin behaved as a high-beta risk asset, amplifying macroeconomic stress rather than offsetting it. The “digital gold” narrative, which had sustained retail enthusiasm for years, evaporated in a cascade of margin calls. For the first time at scale, cryptocurrency moved in lockstep with equity volatility during a geopolitical shock, exposing the illusion that crypto existed in a hermetically sealed ecosystem.

By year-end, Bitcoin had recovered only partially, trading near $85-90k and registering its steepest Q4 decline since 2018. The episode crystallized a hard lesson: crypto is no longer a niche alternative asset; it is a macro asset subject to the same cyclical and geopolitical forces as equities, commodities, and currencies.

Regulatory Clarity Arrives, but on Traditional Finance’s Terms

Perhaps paradoxically, the October crash occurred amid an unprecedented regulatory thaw. In July 2025, President Trump signed the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act) into law, marking the first federal legislation on digital assets in U.S. history. The bill passed the Senate 68-30 on June 17 and the House 308-122 on July 17, demonstrating bipartisan consensus. For a sector that had spent a decade battling regulatory hostility, this was a monumental achievement.

The GENIUS Act established a framework for payment stablecoins that addressed institutional concerns: 1:1 reserve backing, segregation of assets, and custody requirements. Stablecoins issued by compliant institutions became legally exempt from SEC and CFTC oversight, reducing the regulatory ambiguity that had constrained institutional adoption. The legislation did not create a permissionless environment; rather, it created a permissioned one, with clear roles for banks, credit unions, and regulated nonbank issuers.

Simultaneously, the Securities and Exchange Commission implemented a subtle but transformative procedural change in September 2025. Previous spot ETF applications required individual, tailored regulatory review, taking 240-270 days. The new “express lane” framework reduced the maximum timeline to 75 days, a 72% efficiency improvement. This streamlining unlocked rapid expansion beyond Bitcoin and Ethereum: within months, major asset managers filed applications for Solana (with 75% approval probability), XRP (95% approval probability by Q4), Litecoin, and others.

The regulatory pivot reveals a crucial shift in power dynamics. Regulators are no longer obstruction; they are facilitators. However, the framework they have established is decidedly pro-institutional and pro-stablecoin. Startups and decentralized projects found little solace in the GENIUS Act; the legislation created a clear path for regulated intermediaries—established financial institutions—to capture stablecoin issuance. The regulatory victory, in other words, was a victory for legitimacy over decentralization, for Wall Street over Silicon Valley.

The Rise of “Mullet Architecture” and Institutional Quiet

An accurate description of 2025’s institutional strategy is “Mullet Architecture”—fintech in front, crypto in back. Platforms like Robinhood and PayPal, which control customer-facing interfaces and regulatory relationships, integrated cryptocurrency into traditional-looking products while leveraging decentralized rails underneath. Pension funds and wealth managers gained exposure to Solana and XRP through spot ETFs without directly managing cryptographic keys or interacting with blockchain infrastructure. The customer experience remained frictionless and compliant; the settlement layer became crypto-native.

This architectural pattern solved a critical institutional problem: how to access crypto’s liquidity and efficiency benefits while maintaining the risk management and compliance infrastructure that fiduciaries require. It also explained the seeming paradox of the October crash—institutions had made peace with crypto volatility as an asset class feature, but remained risk-averse about operational and custody risks. ETF structures, with custodians and insurance, addressed the latter concern. October’s price decline, by contrast, was simply an asset class repricing that institutions could weather or exploit via “buy the dip” logic.

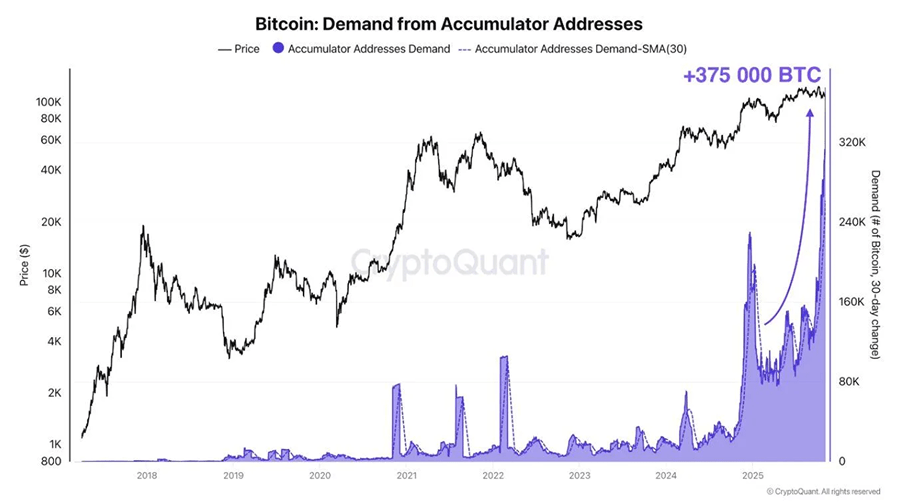

The numbers reflect this bifurcation. U.S. spot Bitcoin ETFs accumulated over 1.36 million BTC (7% of total circulating supply) by year-end. Long-term holders doubled to 262,000 wallets in December, absorbing sell pressure.

Yet retail traders, who had driven much of the initial enthusiasm, showed signs of capitulation: spot Bitcoin ETF holders became net sellers in Q4, reducing positions by 24,000 BTC ($2.12 billion), and trading volumes fell 30%.

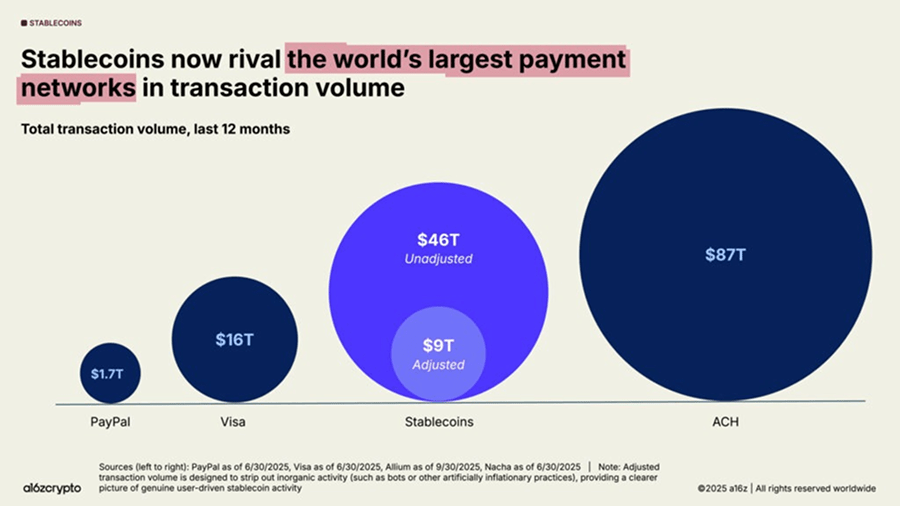

The stablecoin ecosystem exemplifies this institutional penetration most starkly. In 2025, stablecoins processed $46 trillion in total transaction volume (or $9 trillion adjusted for bot activity) over a 12-month period. In September 2025 alone, adjusted transaction volume reached $1.25 trillion per month, approaching the scale of the U.S. Automated Clearing House (ACH) network. These figures dwarf payment volumes of PayPal (roughly $1.75 trillion annually) and approach Visa’s scale. Critically, this volume is not speculative; it reflects genuine adoption by institutions seeking efficient cross-border settlement.

The stablecoin market cap surpassed $300 billion, with Tether (USDT) and Circle’s USDC dominating at approximately 87% combined share. By Q2 2025, Tether alone held $127 billion in U.S. Treasuries ($105.5 billion directly, $21.3 billion indirectly), making it the largest holder among stablecoin issuers. This figure alone—a private cryptocurrency company holding Treasuries at a scale rivaling some nations—would have triggered regulatory chaos five years prior. In 2025, it signaled a transformation in how the U.S. financial system views digital infrastructure.

Technological Maturation Beyond Price Action

While Bitcoin oscillated between greed and fear, three technological sectors achieved genuine maturation independent of price speculation.

Stablecoins as Macro Assets

Stablecoins ceased being a speculative instrument and became structural infrastructure. The GENIUS Act mandated that reserve backing consist of low-risk assets, primarily short-term Treasuries. As the stablecoin market expanded (projected to reach $2 trillion by 2028 under favorable adoption scenarios), the Treasury implications became macroeconomic in scale.

Standard Chartered analyst Geoff Kendrick identified a $750 billion threshold at which stablecoin growth would begin reshaping Treasury market dynamics and monetary policy. With the market already at $300+ billion and growth accelerating, this inflection point is within sight. More remarkably, stablecoins have emerged as strategic buyers for the U.S. dollar and Treasuries at precisely the moment when foreign central banks (most notably China) have been divesting.

ARK Invest projects that stablecoins could hold over $660 billion in Treasuries by 2030, approaching or exceeding China’s current $756 billion. What began as a niche payment mechanism has become, inadvertently, a pillar of U.S. fiscal policy.

Real World Assets (RWAs) and Tokenization

Tokenized government securities and bonds moved from conceptual to operational. As of October 2025, the total tokenized RWA market reached $33 billion, with government securities dominating the use case. Institutions discovered that tokenized T-bills and bond fragments provided both yield and fractional access, appealing to family offices and international investors who previously faced minimum purchase constraints. The broader RWA market is projected to reach $500 billion to $3 trillion over the next five years, with real estate, private credit, and ESG assets layered atop government securities.

DePIN and AI Integration

Decentralized Physical Infrastructure Networks (DePIN) projects reached $30 billion in market capitalization by Q3 2025, with AI-enhanced networks promising autonomous optimization, demand prediction, and dynamic resource allocation. Projects like Helium and Filecoin are offering 70% cost savings relative to centralized data centers and telecommunications providers. The integration of AI agents that autonomously manage resources and accept cryptocurrency as payment for compute services represents a genuine use case beyond speculation—the convergence of AI infrastructure needs with decentralized economic coordination.

Retail Exhaustion, Institutional Patience, and 2026 Outlook

By December 2025, the market had stratified. Retail investors, exhausted by the volatility, dilution (the proliferation of new token launches), and false narratives around “diamond hands” and “$200k Bitcoin“, reduced exposure. The Fear and Greed Index plummeted, trading volumes contracted, and spot Bitcoin ETFs turned into net sellers. Analysts noted classic pre-bear-market “froth-infused behavior,” with retail shifting into altcoins in search of outsized returns—a pattern historically associated with market exhaustion.

Institutions, by contrast, displayed patience bordering on ruthlessness. Rather than panic-selling during the October crash, long-term holders and corporate treasurers (exemplified by MicroStrategy’s aggressive accumulation strategy) viewed the decline as a buying opportunity. The market’s microstructure proved resilient: despite the $19.13 billion liquidation cascade on October 10, no major centralized exchanges failed, and blockchain infrastructure handled trading volume flawlessly (though centralized price oracles exhibited vulnerabilities). This structural stability is itself a milestone—it suggests the ecosystem has outgrown its previous fragility.

Looking ahead to 2026, the narrative will likely pivot from price discovery to macro dependency. The traditional 4-year Bitcoin halving cycle, which reliably produced 3 years of growth followed by 1 year of decline, appears to have broken down. Instead, Bitcoin’s trajectory will be shaped by the Federal Reserve’s monetary policy, tariff escalation (or de-escalation), geopolitical shocks, and the on-ramp of capital from institutions hedging currency debasement and regulatory risk.

The “digital gold” narrative is dead; in its place is a more sober recognition: crypto is a macro asset, subject to duration risk, correlation risk, and geopolitical shocks, but with superior settlement characteristics and programmability for institutions that can tolerate volatility.

The year 2025 bifurcated cryptocurrency history: before mainstream integration and after it. The year delivered both victories—regulatory clarity, institutional adoption, stablecoin scale, technological maturation—and harsh lessons. The hard lesson was existential: crypto had always presented itself as orthogonal to traditional macro risk; it proved to be correlated with it instead. The victory was that institutions, accepting this reality, chose to adopt crypto anyway, building Mullet Architecture that preserved the settlement benefits of blockchain while maintaining traditional risk management.

In this sense, 2025 was not the year crypto conquered finance. It was the year crypto accepted its place within finance—no longer a revolution, but a critical piece of infrastructure. For evangelists, this may feel like a compromise. For pragmatists seeking to deploy capital at scale, it represents the only path forward.

Follow us on Medium, X, Telegram, YouTube, and Publish0x to stay updated about the latest news on StealthEX and the rest of the crypto world.

Don’t forget to do your own research before buying any crypto. The views and opinions expressed in this article are solely those of the author.

2026 Bitcoin crypto world Ethereum how to buy crypto

Share Post