This post was originally published on this site.

Retailers are moving quickly to tighten control over how consumers pay, as new PYMNTS Intelligence data shows embedded finance shifting from a background capability to a frontline business priority.

According to “Retailers Expand Embedded Finance to Unlock Control and Customization,” a November 2025 PYMNTS Intelligence report produced in collaboration with Marqeta, nearly 3 in 4 retailers now rank embedded finance as more important than other innovation initiatives over the next year. The urgency reflects mounting pressure from payment complexity, regulatory exposure and rising fraud risk as retailers deepen their involvement in financial services.

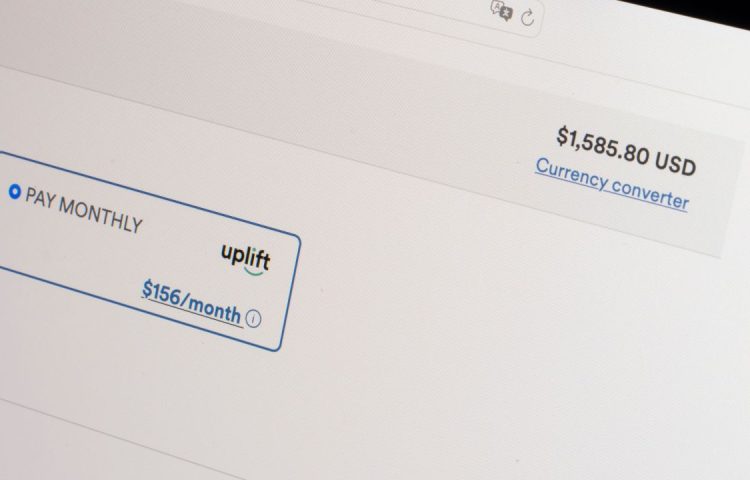

The survey of heads of payments at 37 U.S. retailers and commerce platforms finds that embedded finance adoption is already widespread. Thirty-four of the firms surveyed offer embedded capabilities ranging from payments and wallets to lending and subscription billing. What is changing is how retailers define success. Rather than focusing on incremental revenue, firms are prioritizing operational resilience and governance as embedded finance pulls them closer to regulated activity.

The data point to clear operational gains. Sixty-eight percent of retailers report improved efficiency from embedded finance, while more than half say it improves customer journeys and checkout conversion. Retailers also report better access to customer data and faster speed to market for new products, benefits that have become more critical as consumers juggle multiple payment options across channels.

At the same time, risk concerns are intensifying. Eighty-eight percent of retailers cite regulatory compliance as a challenge when implementing embedded finance. That figure rises to 100% among retailers offering subscription services, where recurring billing and stored credentials heighten oversight requirements. Fraud management is also a persistent concern, particularly for retailers offering credit products.

Those pressures are reshaping vendor selection and internal priorities. Only 11% of retailers measure embedded finance success primarily by return on investment. Instead, strong compliance capabilities and fraud controls now outrank customization, ease of integration and revenue impact when firms evaluate partners.

Advertisement: Scroll to Continue

The shift is especially pronounced among smaller retailers. Three in 4 firms with less than $750 million in annual revenue say embedded finance innovation is now more important than innovation in other areas, signaling an effort to close the gap with larger competitors through tighter control of payments and financial workflows.

The message from the data is direct. Embedded finance is no longer treated as an optional layer at checkout. It is becoming core infrastructure. For retailers facing rising scrutiny and increasingly complex payment behavior, the priority is clear. Control now matters as much as growth.