This post was originally published on this site.

Confidence in the equipment finance industry dipped in December as inflationary concerns and a mixed economic environment led to a more moderate sentiment.

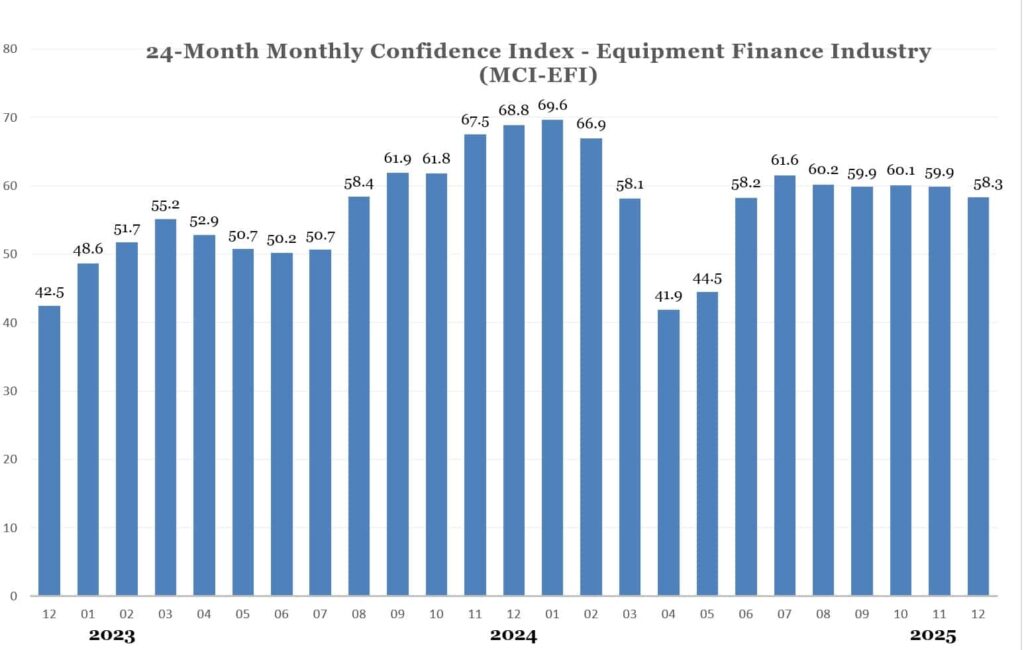

Equipment finance industry confidence landed at 58.3 in December, down compared with 59.9 in November and 68.8 in December 2024, according to the Equipment Leasing & Finance Foundation’s December 2025 Monthly Confidence Index, released on Dec. 18. The December survey consisted of 45.8% banks, 20.8% captives and 33.3% independent finance companies.

Most executives surveyed across the $1.3 trillion industry expect stable business conditions and demand over the next four months, according to the release. In fact, 75% expect CapEx demand to hold steady, up compared with 62.5% in November, while 20.8% anticipate increased demand, flat with November, and 4.2% foresee a decline, down compared to 16.7% last month.

While the current downturn is painful, it is not permanent, and industrial goods sit at the heart of an $8 trillion equipment ecosystem with strong national and global fundamentals, Michael Sharov, a partner in Oliver Wyman’s Transportation and Advanced Industrials practice, told Equipment Finance News.

“What is changing is not the need for equipment, but how it is bought, financed, serviced and digitized,” he said. “That provides a lot more playgrounds for both captives and standalone banks to play in the space, and a lot more tools to OEMs and dealers — if they’re smart about it.”

Wider conditions impact equipment finance

Executives also indicated a more cautious economic outlook, as only 12.5% expect improved business conditions over the next four months, down from 25% in November; 75% expect conditions to remain the same, up from 62.5% last month; and 12.5% expect them to worsen, flat with the previous month, according to the release.

The expectation of only one Federal Reserve rate cut in 2026, on the back of stubborn inflation, also presents a concern for equipment finance, although some companies can still find success, Elevex Capital Chief Executive Jeffry Elliott said in the release.

“I’m concerned about stagflation — inflation with a recession can be very troubling for any business or individual,” he said. “The mixed economic environment will enable entrepreneurial equipment finance companies to thrive.”

Meanwhile, 25% of those polled expect greater access to capital, a decline from 29.2% in November; 70.8% expect the same conditions seen in November; and 4.2% expect reduced access, up compared with none in November.

While expectations remain flat, there is a change of a strong end to 2025 and start to 2026, David Normandin, president and CEO of Wintrust Specialty Finance, said in the release.

“The commercial equipment leasing and financing marketplace is dynamic and provides opportunity for organizations that are nimble and can solve customer problems,” he said. “I think we are in a transition and that change will create opportunity for some and leave others wondering what happened.”

Check out our exclusive industry data here.