This post was originally published on this site.

Find winning stocks in any market cycle. Join 7 million investors using Simply Wall St’s investing ideas for FREE.

-

TeraWulf (NasdaqCM:WULF) is shifting its core business from bitcoin mining to building and operating AI focused infrastructure.

-

The company has recently sold nearly all of its bitcoin holdings and acquired new industrial sites intended to roughly double its available power capacity.

-

These moves signal a company wide pivot toward serving power hungry AI workloads rather than relying on cryptocurrency mining economics.

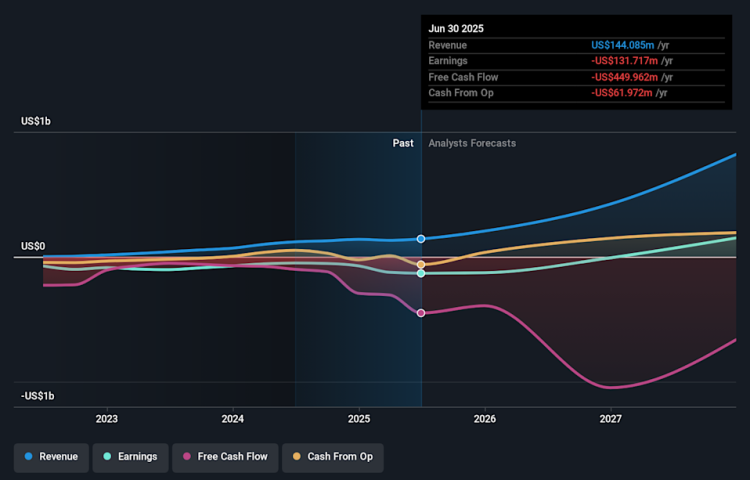

TeraWulf, trading at $16.26, is repositioning itself as an AI infrastructure provider at a time when demand for data center power and capacity is a key talking point across markets. The stock has returned 13.8% over the past week, 17.4% over the past month, and 27.6% year to date, with a very large gain over the past year and an even larger multiple over three years. For investors watching high growth, higher risk names, this kind of business shift can be just as important as short term price moves.

The decision to exit almost all bitcoin exposure and secure new industrial sites gives you a clearer picture of where management wants future cash flows to come from. As the company builds out AI ready power capacity, the key questions will revolve around how quickly it can sign customers, manage capital spending, and turn this new focus into durable revenue streams.

Stay updated on the most important news stories for TeraWulf by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on TeraWulf.

We’ve flagged 2 risks for TeraWulf. See which could impact your investment.

-

⚖️ Price vs Analyst Target: At $16.26, TeraWulf trades about 31% below the US$23.56 analyst consensus target, which indicates a sizeable gap between price and expectations.

-

❌ Simply Wall St Valuation: Simply Wall St’s DCF view is listed as unknown, so you do not have a clear intrinsic value cross check here.

-

✅ Recent Momentum: The 30 day return of 17.4% points to strong recent interest as the AI infrastructure shift gains attention.

There is only one way to know the right time to buy, sell or hold TeraWulf. Head to Simply Wall St’s company report for the latest analysis of TeraWulf’s Fair Value.

-

📊 The move from bitcoin mining to AI oriented power infrastructure changes TeraWulf’s story from crypto exposure to data center style contracts and utilization.

-

📊 Watch how quickly new industrial sites are energized, contracted, and reflected in revenue, along with any updates to earnings forecasts and cash needs.

-

⚠️ The company is flagged as having less than one year of cash runway, which makes execution speed and access to funding especially important for this build out.

For the full picture including more risks and rewards, check out the complete TeraWulf analysis. Alternatively, you can check out the community page for TeraWulf to see how other investors believe this latest news will impact the company’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include WULF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com