This post was originally published on this site.

Never miss an important update on your stock portfolio and cut through the noise. Over 7 million investors trust Simply Wall St to stay informed where it matters for FREE.

-

Robinhood Markets (NasdaqGS:HOOD) has launched the public testnet of Robinhood Chain, an Ethereum Layer 2 network aimed at 24/7, low fee on chain trading of tokenized equities and ETFs.

-

The company is pushing further into decentralized finance while also pursuing product diversification, including areas such as prediction markets and international expansion.

-

A new CFO is in place as crypto related revenues soften, coinciding with these product and platform shifts.

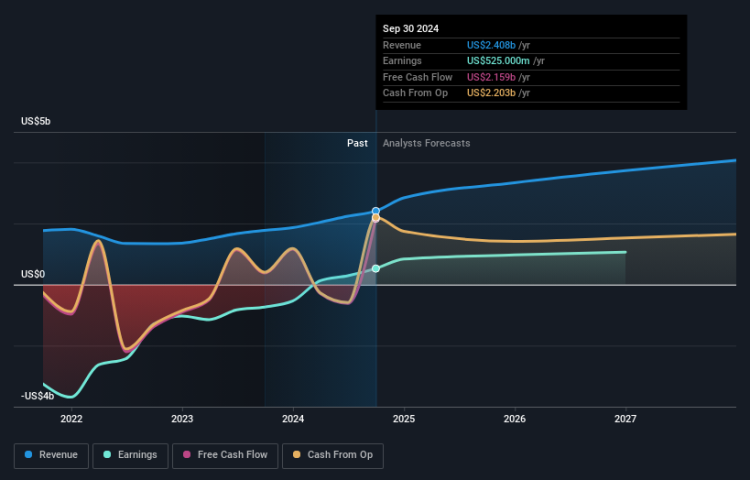

Robinhood Markets, trading at $75.97, sits at an interesting point in its public market life, with a very large 3 year return and a 16.4% return over the past year, alongside sharp pullbacks of 8.3% over the past week and 36.5% over the past month. Year to date, the stock shows a 34.1% decline. This provides important context for investors watching how the market responds to Robinhood Chain, new products, and leadership changes.

For investors, a central question is how Robinhood balances its core brokerage franchise with its push into on chain trading, prediction markets, and overseas users. As the new CFO reshapes priorities and crypto revenues soften, the mix of products that gain traction with Robinhood’s large retail base may be a significant factor in how the NasdaqGS:HOOD story develops from here.

Stay updated on the most important news stories for Robinhood Markets by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Robinhood Markets.

We’ve flagged 2 risks for Robinhood Markets. See which could impact your investment.

For Robinhood, launching Robinhood Chain while crypto transaction revenue fell 38% in Q4 2025 looks like an attempt to reset how its crypto and tokenization business works. Instead of relying purely on trading volumes, the company is trying to own more of the infrastructure through an Ethereum Layer 2 built on Arbitrum, plus prediction markets and tokenized equities. That could change the business model from mostly transaction-driven to a blend of trading, fees from on-chain activity, and developer usage. At the same time, the new CFO steps in just as net income in Q4 declined year on year, even though full year revenue and earnings were higher than in 2024. This puts execution and cost discipline in the spotlight. The share buyback of US$909.51m since May 2024 also shows management was comfortable committing capital to equity repurchases while it invests in products like Robinhood Chain, prediction markets, and international expansion. For you as an investor, the key question is whether these moves offset the current weakness in crypto trading and justify Robinhood competing more directly with players such as Coinbase, Interactive Brokers, and traditional brokers that are also leaning into digital assets.

-

Robinhood Chain and tokenized real-world assets directly support the narrative that diversification into new products and markets can create additional recurring revenue streams beyond traditional trading.

-

The Q4 revenue miss, softer net income, and crypto revenue decline highlight the risk from regulatory and product uncertainty around alternative assets that the narrative flags as a possible brake on growth.

-

The move to own an Ethereum Layer 2 and push deeper into prediction markets is only briefly referenced in the narrative. The potential impact of owning more infrastructure and a CFTC licensed venue may therefore not be fully reflected in those assumptions.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Robinhood Markets to help decide what it’s worth to you.

-

⚠️ Robinhood still has meaningful exposure to crypto trading, and a 38% drop in crypto transaction revenue in Q4 2025 shows how swings in digital asset activity can affect results.

-

⚠️ Building Robinhood Chain, expanding prediction markets, and scaling internationally increase execution and regulatory risk, especially as regulators review tokenized assets and event contracts.

-

🎁 Full year 2025 revenue of US$4.47b and net income of US$1.88b, both higher than 2024, suggest the broader product set is contributing to growth even while one segment such as crypto softens.

-

🎁 The completed buyback of over 22.3m shares for about US$909.51m, plus investment in on-chain infrastructure and prediction markets, shows management is actively reshaping the business while also managing capital returns.

From here, it is worth tracking how quickly Robinhood migrates stock tokens and other products onto Robinhood Chain, and whether that leads to higher engagement or lower costs per trade. Monitor the contribution from prediction markets and subscriptions relative to more volatile options and crypto revenue, as that mix will say a lot about earnings stability. The new CFO’s first few quarters of expense guidance and commentary on capital allocation, including any extension of the buyback, will also be informative. Finally, keep an eye on how competitors such as Coinbase, Charles Schwab, and Interactive Brokers respond to tokenization and 24/7 trading to see whether Robinhood’s early move into Ethereum Layer 2 gives it any clear differentiation.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Robinhood Markets, head to the community page for Robinhood Markets to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include HOOD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com