This post was originally published on this site.

Find winning stocks in any market cycle. Join 7 million investors using Simply Wall St’s investing ideas for FREE.

-

Regions Financial (NYSE:RF) has appointed Kafi Slaughter as Area Wealth Leader for Private Wealth Management in key Texas markets.

-

The company has adopted amendments to its by laws affecting shareholders’ ability to request special meetings and updating director nomination procedures.

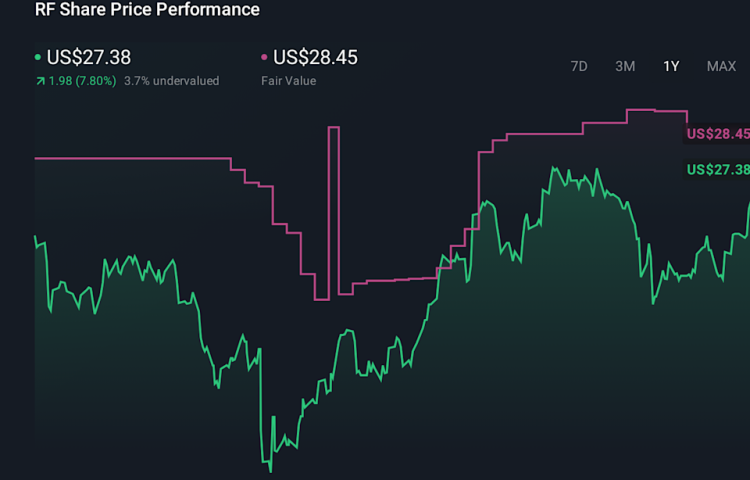

Regions Financial, trading at $29.78, sits in the spotlight as it reshapes both its leadership bench and governance framework. The stock has a 1 year return of 29.2% and a 5 year return of 85.1%, which may catch the eye of investors tracking longer term performance. In this context, the move to reinforce its Private Wealth Management presence in major Texas markets adds another layer to the story for NYSE:RF.

The appointment of an experienced wealth leader and the changes to by laws around shareholder meetings and nominations give investors fresh information to factor into their view of the company. Investors can monitor how Regions Financial executes in those Texas markets and how the updated governance rules influence shareholder engagement and board level decisions over time.

Stay updated on the most important news stories for Regions Financial by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Regions Financial.

The appointment of Kafi Slaughter to lead Private Wealth Management across Houston, Austin, and San Antonio points to Regions Financial putting more weight behind fee-based wealth revenue in key Texas markets. For you as an investor, this ties directly to how the bank balances interest income from lending with steadier wealth and advisory fees. Slaughter’s three decades in private banking at peers like Bank of America and Wells Fargo give Regions an experienced hand to compete for high net worth clients where large national banks and regional players such as Truist and PNC are active. At the same time, the by-law amendments fine tune how shareholders can call special meetings and nominate directors. Allowing holders of at least 25% of shares to request a special meeting, while simplifying some disclosure requirements, can affect how quickly large investors respond to capital allocation, M&A, or risk issues. The tighter definition of which executives qualify for indemnification also clarifies where legal protections sit at the top of the house. Together, leadership moves and governance tweaks give you more clues about how Regions thinks about long-term growth, shareholder influence, and boardroom accountability.

-

The push into key Texas wealth markets fits with a narrative that Regions is focusing on select markets to build out loan, deposit, and fee-income opportunities over time.

-

Greater shareholder ability to call special meetings could challenge management if results or credit quality trends fall short of expectations and large investors seek faster changes.

-

The specific governance updates around nominations, disclosures, and indemnification go beyond the existing story that focuses mainly on growth, buybacks, and credit costs.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Regions Financial to help decide what it’s worth to you.

-

⚠️ Execution risk if the wealth build out in Texas does not gain traction against entrenched competitors and does not translate into stronger fee income or deeper client relationships.

-

⚠️ The lower threshold for calling special meetings could lead to more frequent shareholder campaigns if larger holders become dissatisfied, potentially adding governance friction and management distraction.

-

🎁 A seasoned wealth leader with experience at large banks may help Regions deepen its presence in important Texas markets and broaden non interest income over time.

-

🎁 Clearer by-law language and officer definitions can provide more transparency around governance, which some long-term investors consider when assessing board oversight and management accountability.

From here, you might track whether Regions reports progress in Texas wealth client acquisition, assets under management, and related fee income as Slaughter settles into the role. It is also worth watching any signs that large shareholders use the revised special-meeting rights, for example around topics such as capital returns, risk appetite, or leadership changes. Management commentary at investor conferences and in future filings can give you more detail on how these governance updates affect board processes and how the Texas wealth push fits alongside Regions’ broader priorities in the Southeast and Sun Belt.

To stay informed on how the latest news affects the investment narrative for Regions Financial, visit the community page for Regions Financial to follow the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include RF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com