This post was originally published on this site.

(Bloomberg) — Logistics stocks plunged on Thursday as the group became the latest victim of the artificial intelligence “scare trade.” At the center of the selloff: a former karaoke company with a stock-market value of $6 million.

The little-known company is worth just a fraction of the value it knocked off of a constellation of others — all of which were rapidly dumped by investors fearful of even the faintest threat posed by AI.

Most Read from Bloomberg

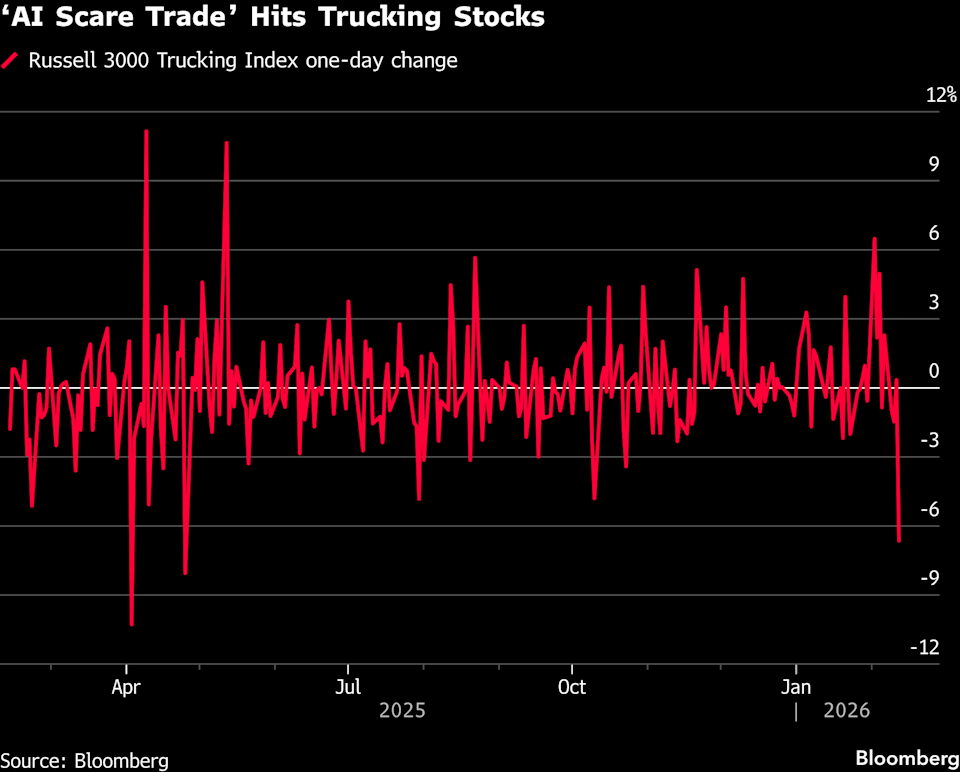

The company’s trumpeting of its logistics platform sent the Russell 3000 Trucking Index sliding . CH Robinson Worldwide Inc. tumbled — and at one point was down by a record 24% — while Landstar System Inc. fell .

It was the worst drop for the sector since April’s trade-war market meltdown. Drug distribution stocks were also caught up in the selloff, with McKesson Corp. and Cardinal Health Inc. both sliding about 4%.

Algorhythm Holdings Inc., which previously traded as The Singing Machine Company Inc., announced that its SemiCab platform was helping its customers scale freight volumes by 300% to 400% without a corresponding increase in operational headcount.

Algorhythm used to sell karaoke products until rebranding in 2024 as an AI logistics firm. It reported less than $2 million in sales for the quarter that ended on Sept. 30, with a net loss totaling nearly $3 million for the period. But its shares soared to $1.08 after its announcement, paring what had been a jump of as much as 82% earlier in the session.

The movements underscored how much angst has built up around AI. Concern that new AI-powered tools and applications can upend the business models of many industries has sparked brutal selloffs in several corners of the stock market over the past couple weeks — starting with software makers, then spilling over to private credit companies, insurers, wealth managers, real estate services and now, logistics firms.

“I would probably be more inclined to be skeptical that this particular company is gonna be the one to disrupt the industry,” Citigroup Inc.’s Ariel Rosa said, referring to Algorhythm. “But the notion that someone will eventually come in and try to disrupt the industry seems like a decently high probability.”

The logistics selloff extended to Europe, with Denmark’s DSV A/S closing down 11%. Swiss firm Kuehne + Nagel International AG slid 13%.

Investors had seen transportation as part of the “AI resistant” trade, particularly as volatility in technology names caused a push to diversify portfolios. However, the selloff has proved that even the “old economy” is not immune to the AI concerns that have been wreaking havoc on the market.

“The worry is that it could disintermediate the truck brokers, which is why they’re getting hit so much,” said Christopher Kuhn, a Benchmark analyst covering trucking stocks. “The whole sector is getting hit, but it’s mostly on the broker side.”

“I guess it was their time,” Kuhn added. “I think it’s overdone but we need more detail. But clearly it’s unlikely that a big corporation is going to put in this software and not use a major truck broker like CH Robinson and RXO.”

Jeffrey Favuzza, who works on the equity trading desk at Jefferies, said the downward slide in freight logistics firms highlights a broader theme across the market.

“For every corner of the market right now is an aggressive shoot first ask questions later for any area of the market that has an AI headline,” he wrote in a note to clients.

Knee-Jerk Reaction

Analysts and investors have warned that some of this steep selling reflects a knee-jerk reaction and could be overestimating the risk.

“Today’s selloff appears largely blind to the idea that the group appears to be at a cyclical inflection point, driven by reduced supply as well as the potential impact of fiscal,” Baird’s Daniel Moore wrote in a note.

Meanwhile, Barclays analyst Brandon Oglenski defended CH Robinson, as well as other asset-light transport companies, seeing the reaction as “disproportionate to the risk.” Oglenski added that he would be a buyer of the sector on weakness, particularly in CH Robinson shares.

“While the impact from AI over time is inevitable and powerful, stock reactions to news like this tend to be emotional and exaggerated,” said Mark Hackett, chief market strategist at Nationwide.

Citigroup’s Rosa said the broad declines in transport stocks needs to be seen within the context of growing valuations. He was not surprised investors were “a little bit more jittery” given how high valuations were.

“It’s going to play out over the course of months and quarters and years, but today feels like the realization that others might be able to replicate or displace or emulate what CH Robinson has made a lot of progress in adopting,” said Rosa.

–With assistance from Janet Freund.

(Updates shares, adds additional details and quotes throughout.)

Most Read from Bloomberg Businessweek

©2026 Bloomberg L.P.