This post was originally published on this site.

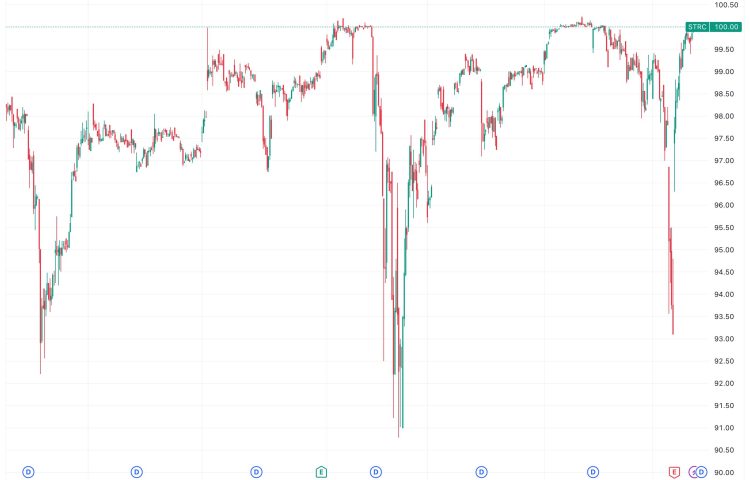

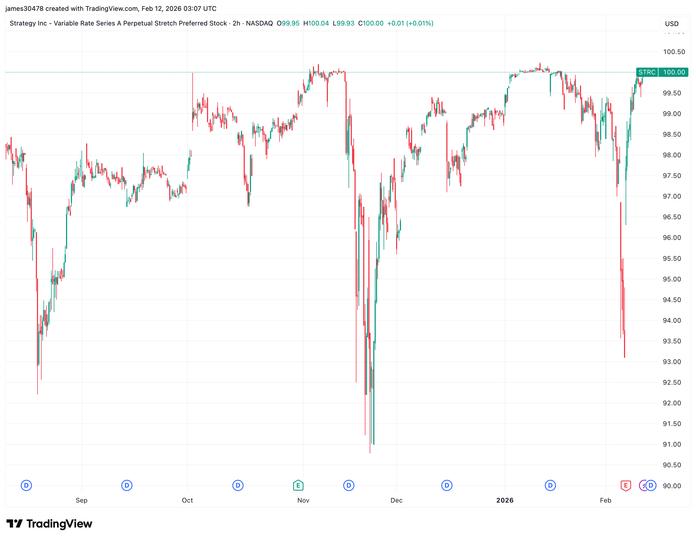

Stretch (STRC), the perpetual preferred equity issued by Strategy (MSTR) the world’s largest corporate bitcoin holder reclaimed its $100 par value during Wednesday’s U.S. session for the first time since mid-January.

STRC trading at or above par enables the company to resume at-the-market (ATM) offerings to fund further bitcoin acquisitions. STRC last hit the $100 level on Jan. 16 when bitcoin hovered near $97,000; however, as the largest cryptocurrency by market capitalization retreated to as low as $60,000 by on Feb. 5, STRC dipped to a low of $93 before its recent rebound.

STORY CONTINUES BELOW

Positioned as a short-duration, high-yield credit instrument, STRC currently offers an 11.25% annual dividend distributed monthly. To mitigate volatility and incentivize trading near par, Strategy resets this rate monthly, recently hiking it to the current 11.25% yield.

MSTR common stock faced pressure, sliding 5% on Wednesday to close at $126, as bitcoin hovers around $67,500.