This post was originally published on this site.

The market isn’t convinced Netflix’s acquisition of Warner Bros. Discovery will pay off.

Since reaching an all-time high on June 30, 2025, Netflix (NFLX +0.87%) stock has been under pressure — falling 30% in the second half of 2025.

In December, I predicted that Netflix would crush the S&P 500 (^GSPC 0.33%) from 2026 through 2030. But the streaming stock is already down 12.3% year to date while the S&P 500 is up 1.3%.

Here’s what’s driving the sell-off in Netflix stock and if it’s still a buy now.

Image source: Netflix.

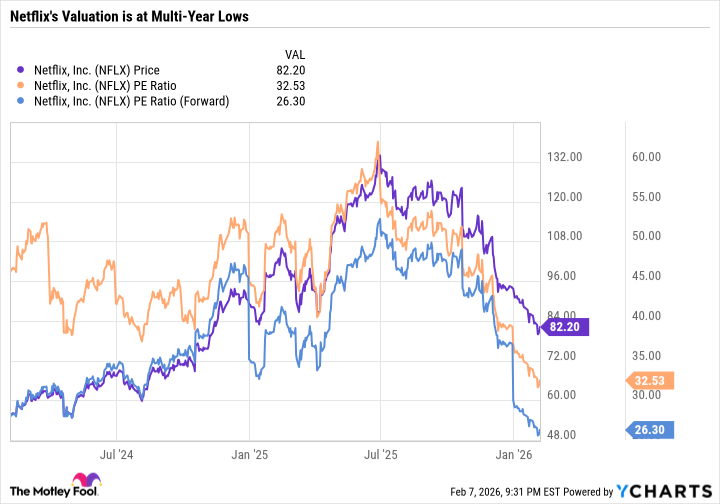

Netflix’s valuation has plummeted

Netflix finished 2025 with an ultra-strong balance sheet — consisting of just $4.4 billion in long-term debt net of cash and cash equivalents. It produced $13.3 billion in 2025 operating income and $11 billion in net income on $45.2 billion in revenue — good for an operating margin of 29.4% and an after-tax net profit margin of 24.3%.

Netflix is a financially healthy, high-margin cash cow with predictable recurring revenue and a global audience. Despite challenges with consumer spending, Netflix continues to grow — coming off a record $2.53 in 2025 earnings per share.

These qualities make Netflix the kind of company long-term investors dream about — and that was reflected in its valuation. At its peak, Netflix was trading at over 60 times trailing earnings and over 50 times forward earnings. The sell-off has pushed Netflix’s price-to-earnings (P/E) ratio down to just 32.5 and its forward P/E down to 26.3.

In just seven months, Netflix has gone from an expensive growth stock to commanding only a slight premium to the S&P 500’s 23.6 forward P/E.

The market hates uncertainty

Part of Netflix’s sell-off may have been valuation-related. But now that Netflix is far less expensive than it used to be, investors may be wondering why Wall Street isn’t rushing in to smash the buy button.

The simple answer is uncertainty.

On Dec. 5, Netflix announced it would acquire Warner Bros. Discovery (WBD +2.17%) for $27.75 per share in cash and stock — but more specifically, Warner Bros. following the separation of Discovery Global. The deal has an enterprise value of $82.7 billion, which includes $10.7 billion in net debt.

Warner Bros. is more debt-heavy than Netflix, which will make its balance sheet more leveraged. Then on Jan. 20, 2026, Netflix said that it amended its agreement with Warner Bros. Discovery to an all-cash transaction. To make that happen, Netflix will need to take on new debt, further straining its balance sheet.

Netflix is a compelling buy

Warner Bros. will bolster Netflix’s intellectual property, content library, and content creation capabilities. HBO and HBO Max will likely become stable streaming services and bundle with Netflix.

Despite the potential for faster earnings growth, the deal definitely takes a sledgehammer to Netflix’s high-margin, low-leverage nature as a stand-alone business. Investors who don’t want to be a part of that added risk may prefer to sell the stock rather than waiting to see if the acquisition pays off.

However, folks who believe the acquisition makes sense and Netflix will be able to pay down the debt in a reasonable amount of time are getting a phenomenal chance to buy the stock for a relatively cheap valuation.

All told, Netflix stands out as an excellent buy now, but it wouldn’t surprise me if the stock remained beaten down until investors get more clarity into what the business will look like post-acquisition, if it even goes through, and how Netflix plans to monetize the Warner Bros. assets.