This post was originally published on this site.

Find your next quality investment with Simply Wall St’s easy and powerful screener, trusted by over 7 million individual investors worldwide.

-

Cleveland-Cliffs (NYSE:CLF) has secured new contracts with major automotive clients, expanding its position in the auto steel supply chain.

-

The company expects to benefit from Canadian trade policy that restricts certain steel imports into Canada.

-

Cleveland-Cliffs has ended a large, low margin contract with ArcelorMittal that had weighed on profitability.

-

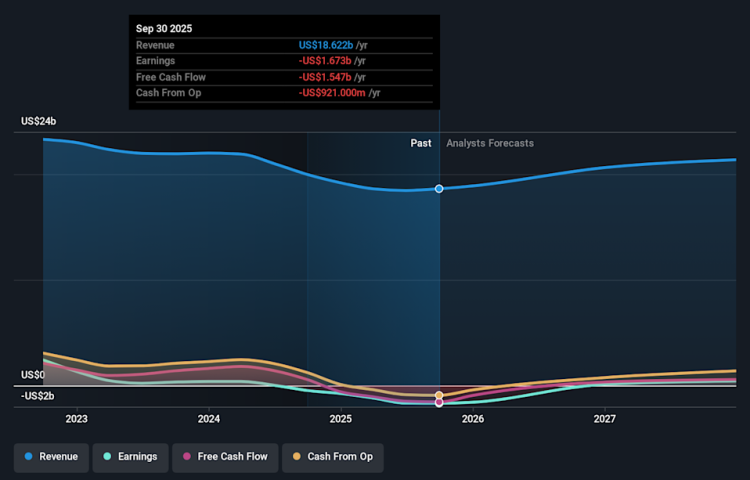

Management is working toward a turnaround effort targeted for 2026, while the company continues to report losses.

Cleveland-Cliffs is a vertically integrated steel and mining company with a heavy focus on supplying flat-rolled steel to automakers, so contract wins in that sector can be important for its order book and pricing. At the same time, Canadian trade policy that limits some steel imports may support demand for regionally produced steel, which can matter for a supplier like Cleveland-Cliffs that serves North American markets.

For investors, the end of a large, low margin contract with ArcelorMittal removes a line of business that had been a drag on value creation and EBITDA. Management is pointing to 2026 as a key year for turnaround efforts. The mix of new automotive business, changing trade conditions, and contract changes is central to how the NYSE:CLF narrative develops from here, particularly while the company continues to work through ongoing losses.

Stay updated on the most important news stories for Cleveland-Cliffs by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Cleveland-Cliffs.

How Cleveland-Cliffs stacks up against its biggest competitors

-

✅ Price vs Analyst Target: At US$12.31 versus a consensus target of US$13.49, the price sits about 10% below where analysts are on average.

-

✅ Simply Wall St Valuation: Simply Wall St currently flags the shares as trading about 75.6% below its estimate of fair value.

-

❌ Recent Momentum: The 30 day return of roughly 3.5% decline shows weak short term sentiment despite the contract news.

Check out Simply Wall St’s in depth valuation analysis for Cleveland-Cliffs.

-

📊 New auto contracts and Canadian trade support tie Cleveland-Cliffs more tightly to North American auto and steel demand while it exits a low margin arrangement.

-

📊 Keep an eye on progress toward the 2026 turnaround plan, net income moving off the current US$1.7b loss, and how earnings track versus the current negative P/E.

-

⚠️ Major risks include weak earnings, debt not well covered by operating cash flow, and recent shareholder dilution, which all add pressure while losses persist.

For the full picture including more risks and rewards, check out the complete Cleveland-Cliffs analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CLF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com