This post was originally published on this site.

-

Federated Hermes, Inc. recently reported fourth-quarter 2025 results showing higher revenue of US$482.83 million and net income of US$107.04 million year-on-year, while also affirming a US$0.34 dividend and completing share repurchases under two buyback programs.

-

Alongside these financial updates, the company outlined a leadership transition in its US$242.70 billion Prime Liquidity Group, promoting veteran portfolio manager Mark Weiss to succeed long-serving executive Paige Wilhelm after her planned July 2026 retirement.

-

Next, we will examine how the robust earnings momentum and continued capital returns shape Federated Hermes’ broader investment narrative.

This technology could replace computers: discover 22 stocks that are working to make quantum computing a reality.

To own Federated Hermes, you need to be comfortable with a steady, cash‑generative asset manager that trades at what many see as a discount multiple, but with only modest revenue and earnings growth expected. The latest quarter’s higher revenue and net income, paired with a maintained US$0.34 dividend and completed buybacks, reinforce a story centered on ongoing capital returns rather than rapid expansion. Near term, the key catalysts still sit around flows into its money market and fixed income products, and how markets treat managers with slower top‑line growth. The newly announced leadership changes in the Prime Liquidity Group and across fixed income look more like succession planning than a break in strategy, so they do not obviously alter those catalysts, but they do introduce execution risk during a period of elevated expectations for return on equity and earnings quality.

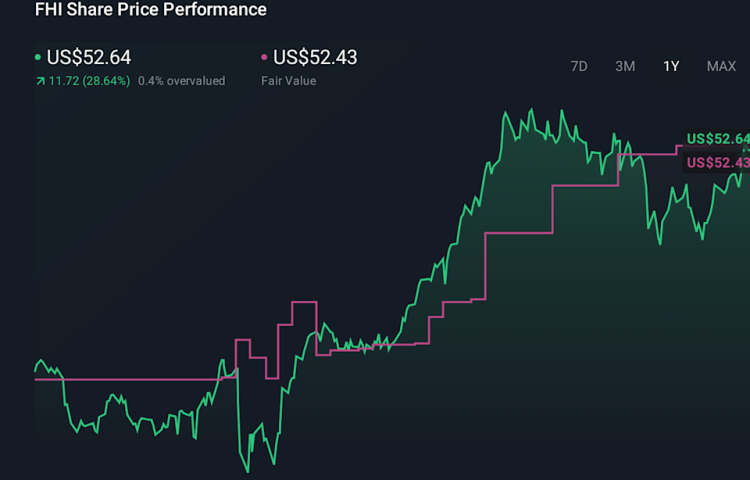

However, one risk investors should be aware of is the brewing execution risk around this leadership transition. Despite retreating, Federated Hermes’ shares might still be trading 18% above their fair value. Discover the potential downside here.

The Simply Wall St Community’s four fair value estimates for Federated Hermes span roughly US$52 to US$63 per share, underscoring how far apart individual views can be. Set against succession changes in key cash‑management and fixed income roles, these differing opinions underline why you may want to weigh multiple perspectives on how leadership stability could influence the company’s ability to sustain its current profitability profile.

Explore 4 other fair value estimates on Federated Hermes – why the stock might be worth just $52.35!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include FHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com