This post was originally published on this site.

Track your investments for FREE with Simply Wall St, the portfolio command center trusted by over 7 million individual investors worldwide.

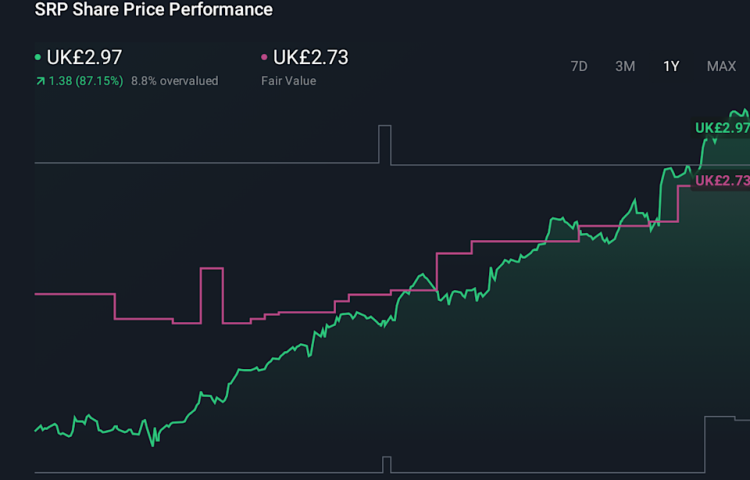

The latest update on Serco Group fine tunes the fair value estimate from £2.71 to £2.73 per share, keeping it closely aligned with recent analyst targets in the mid £2 range. This small shift reflects fresh research where higher targets up to £2.75 are tied to updated assumptions on discount rates and long term cash flows, rather than short term share price moves. Read on to see how you can monitor these evolving price targets and the narrative that sits behind them.

Stay updated as the Fair Value for Serco Group shifts by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Serco Group.

🐂 Bullish Takeaways

-

Recent research skews constructive, with multiple firms moving Serco Group price targets higher into the mid £2 range, which aligns with the updated fair value estimate of £2.73 per share.

-

Deutsche Bank raised its Serco Group price target to 245 GBp from 215 GBp while maintaining a Hold rating. This points to a view that execution and cash flow visibility support a higher valuation reference point even for more neutral analysts.

-

Berenberg, through analyst Alex, lifted its Serco Group price target by 30 GBp. This reinforces the idea that recent work on discount rates and long term cash flows is feeding into a more supportive stance on the shares.

-

Across these updates, analysts are effectively rewarding execution and long term cash generation. They are also still flagging usual reservations around valuation, how much upside is already priced in, and near term risks to the thesis.

🐻 Bearish Takeaways

-

The Hold rating from Deutsche Bank suggests that, despite a higher 245 GBp target, some analysts see current pricing as already reflecting much of the expected execution and cash flow, which can cap near term upside.

-

The emphasis on discount rate and long term cash flow assumptions in the higher targets underlines that these valuation marks are sensitive to changes in inputs. Any shift in sentiment or assumptions could quickly affect how generous these targets look.

Do your thoughts align with the Bull or Bear Analysts? Perhaps you think there’s more to the story. Head to the Simply Wall St Community to discover more perspectives or begin writing your own Narrative!

-

Serco issued full year 2026 guidance with revenue expected at £5.0b and organic growth of 3%, with the outlook weighted to defence activities.

-

The company appointed Mark Reid as Chief Financial Officer, effective 6 March 2026, with a handover from retiring CFO Nigel Crossley starting on 9 February 2026 after his 11 year tenure.

-

Reid joins from Proximus, where he was Group CFO and interim CEO of the international division, and brings over 20 years of international finance experience across Proximus, Liberty Global, Virgin Media, British Airways and Yahoo Inc.

-

Serco secured a contract of around £500m to manage HMP Dovegate in Staffordshire, running for 12 years with three optional one year extensions. The contract includes service changes such as new education delivery models and additional job opportunities on top of an existing workforce of more than 500 people.

-

The fair value estimate has been adjusted slightly from £2.71 per share to £2.73 per share, keeping the updated figure closely aligned with recent analyst targets.

-

The discount rate has moved modestly from 7.70% to about 7.75%, which makes the valuation model a touch more conservative on future cash flows.

-

Revenue growth is now set at roughly 3.57% compared with 3.58% previously, a very small change that keeps growth expectations broadly in line with earlier assumptions.

-

The net profit margin has been nudged up from about 4.12% to around 4.18%, reflecting a slightly higher assumed level of profitability in the model.

-

The future P/E is now set at roughly 15.61x versus 15.65x previously, a small adjustment that leaves the valuation multiple largely unchanged.

Narratives on Simply Wall St let you connect the story you believe about a company with hard numbers like fair value, revenue, earnings and margins. Each Narrative links Serco Group’s business outlook to a forecast and a fair value, then compares that to today’s share price to help you decide what to do. Narratives live on the Community page, are easy to follow, and refresh when new news or earnings arrive so the story and the numbers stay in sync.

If you want the full context behind Serco Group’s latest fair value moves, follow the original Narrative here: SRP: Fair Value View Will Rely On Execution And New CFO Transition. You will be kept up to date on:

-

How growth in government defense spending, and focus on higher margin sectors, feeds into revenue, margins and order pipeline expectations for Serco Group.

-

What the new CFO transition, digital investment and geographic expansion assumptions mean for the 3.6% revenue growth, margin uplift and 2028 earnings forecast.

-

Which risks around regulation, ESG pressure, competition and contract cycles could challenge the fair value view and the analysts’ P/E and discount rate assumptions.

Once you have read the Serco Group Narrative, use it as a reference point alongside our other tools to track how the story and valuation evolve over time, and stay plugged into fresh community views through Curious how numbers become stories that shape markets? Explore Community Narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SRP.L.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com