This post was originally published on this site.

Make better investment decisions with Simply Wall St’s easy, visual tools that give you a competitive edge.

-

Cisco Systems (NasdaqGS: CSCO) has entered a long term Virtual Power Purchase Agreement to support four new solar projects in Poland.

-

The VPPA is being executed through the Net Zero Consortium for Buyers to increase renewable power capacity in the region.

-

The agreement aligns with Cisco’s wider sustainability and decarbonization commitments across its global operations.

Cisco Systems, trading at $84.82, has seen its share price move strongly, with the stock up 8.3% over the past week and 14.7% over the past month. Returns of 11.5% year to date and 39.5% over the past year frame this new VPPA as part of a broader period of momentum for NasdaqGS: CSCO.

For investors watching how large tech companies link environmental goals with long term business planning, this kind of power agreement can be an important data point. It provides another angle to track how Cisco is aligning energy sourcing with its sustainability targets and broader European commitments.

Stay updated on the most important news stories for Cisco Systems by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Cisco Systems.

How Cisco Systems stacks up against its biggest competitors

-

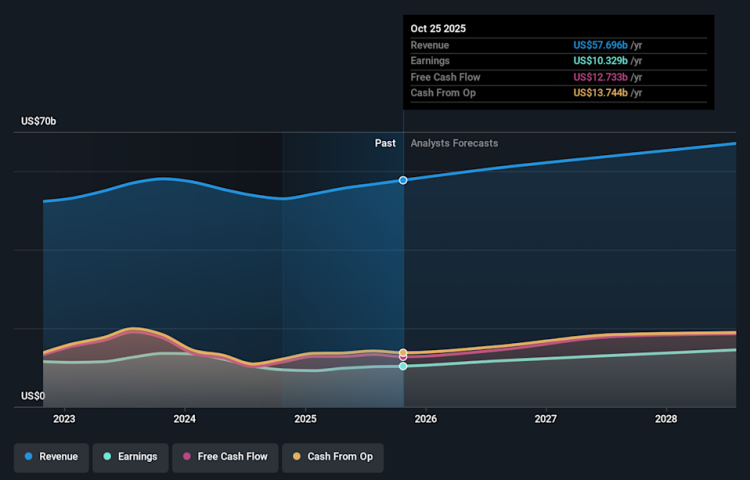

⚖️ Price vs Analyst Target: Cisco trades at US$84.82 versus a consensus price target of about US$86.95, roughly 2.5% below that mark.

-

⚖️ Simply Wall St Valuation: The shares are described as trading close to estimated fair value, with only a 1.3% discount.

-

✅ Recent Momentum: The stock has returned about 14.7% over the last 30 days, indicating strong recent momentum.

Check out Simply Wall St’s in depth valuation analysis for Cisco Systems.

-

📊 The Poland VPPA and wider sustainability commitments may support Cisco’s positioning with customers and regulators who are focused on decarbonization.

-

📊 Watch how this agreement feeds into Cisco’s long term energy costs, margins and any disclosures around progress toward emissions targets.

-

⚠️ One flagged issue is recent significant insider selling, which some investors may weigh against the positive sustainability narrative.

For the full picture including more risks and rewards, check out the complete Cisco Systems analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.