This post was originally published on this site.

Author: Jack Inabinet, Source: Bankless, Compiled by: Shaw from Golden Finance

It has been a terrible day—this is when your friends or family might send you a text asking if everything is alright.

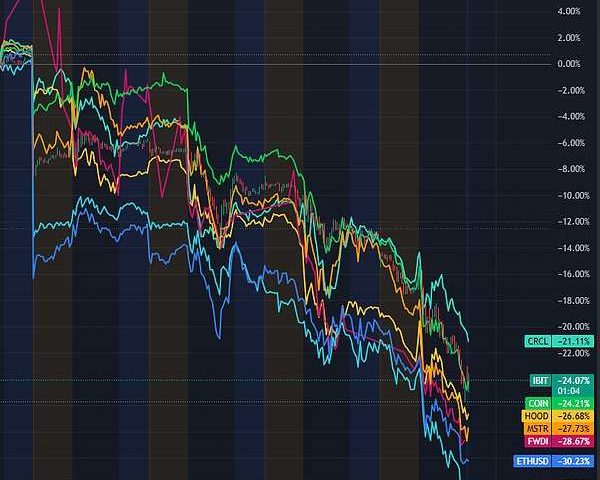

Both Ethereum (ETH) and Bitcoin (BTC) experienced double-digit percentage declines. CoinGlass reported that over $2 billion in cryptocurrency liquidations occurred in the past 24 hours. Strategy shares fell by 17%, with the entire cryptocurrency market trending downward. Meanwhile, one-third of the top 100 cryptocurrencies saw their market capitalization drop by at least a quarter this week.

Today’s sell-off was aggressive and unrestrained, firmly dragging the entire cryptocurrency industry into a bear market. While there may be an impulse to buy the dip, historical evidence suggests it is wiser to wait until the dust settles before taking action.

Today’s sell-off was aggressive and unrestrained, firmly dragging the entire cryptocurrency industry into a bear market. While there may be an impulse to buy the dip, historical evidence suggests it is wiser to wait until the dust settles before taking action.

Conditions are harsh and fraught with risks.

Anyone who believed the cryptocurrency market would sail smoothly by February 2026 faced a harsh reality check this week.

While earlier in the week, daily declines for many major crypto assets were limited to single digits, Thursday’s market crash proved more destructive, causing double-digit drops and wiping out all key elements related to cryptocurrencies.support level,。

Bitcoin erased a month’s worth of gains overnight, falling below $63,000 for the first time since October 2024; Ethereum dropped below $2,000, nearly erasing all gains from its 2025 bull run; Solana’s price fell below $80 for the first time since 2023.

The sell-off spread to digital asset treasury stocks, with share prices following spot prices downward. Strategy fell by 17%, BitMine by 14%, and FWDI by 10%. Cryptocurrency-focused exchanges were not spared either. HOOD dropped by 10%, and COIN plummeted by 13%. Issuing dollars failed to provide protection, as even stablecoin-linked stocks were affected. CRCL shares fell by 9% to hit a new low, now teetering on the brink.

It is safe to say that the current situation does not look optimistic.

A key question you might be wondering is: why now?

An article published by my colleague David on Monday proposed some possible answers – he believes that the change in leadership at the Federal Reserve triggered a rush to purchase assets such as precious metals,safe-haven assetsthe prices of which subsequently experienced roller-coaster-like fluctuations.

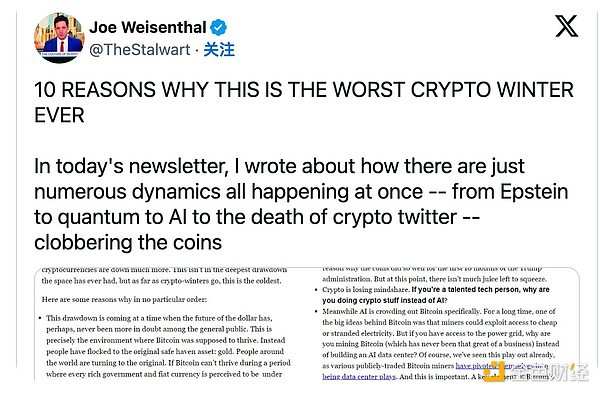

It is difficult to pinpoint the trigger for this indiscriminate sell-off, but one fact may be crucial: the cryptocurrency market is indeed mired in a bear market.

Most cryptocurrencies lack traditional value backing, and their pricing is often influenced by speculators. These characteristics contribute to their inherent volatility, making the cryptocurrency market an effective leading indicator for future financial conditions.

The S&P 500 Index closed less than 3% below the new high set last Wednesday, but several warning signs have raised concerns among technology investors, including poor performance in software stocks, statistically almost impossible fluctuations in major commodities markets, and widespread doubts about whether the artificial intelligence boom can be sustained.

Regardless of whether this cryptocurrency bear market serves as an early warning of deteriorating macroeconomic conditions or turns out to be another false alarm, today’s market movements have undoubtedly dealt a heavy blow to market sentiment and sounded the alarm for many cryptocurrency enthusiasts on social media.

While the social media accounts you follow might panic-sell behind the scenes while publicly encouraging you to buy the dip, most seasoned investors advise against trying to catch a falling knife. Taking time to cool off, forming your own judgment on future trends, and then adjusting your positions accordingly instead of rushing into buying or selling are generally wise approaches. However, this is a lesson each cryptocurrency investor must experience firsthand.

We have been through situations like this before and survived. But that doesn’t mean things will be any easier now.