This post was originally published on this site.

Key Takeaways

- U.S. Treasury Secretary Scott Bessent says Washington has no authority and no intention to bail out Bitcoin investors.

- Any Bitcoin held by the U.S. government will come only from asset seizures, not taxpayer-funded purchases.

- Bitcoin slipped below $70,000 in early February 2026, extending a brutal start to the year as macro pressures mount.

As Bitcoin slid toward fresh yearly lows near $70,000, U.S. Treasury Secretary Scott Bessent delivered a blunt reality check to investors.

There will be no government rescue.

Despite speculation around a potential U.S. Bitcoin reserve, Bessent made it clear that Washington has neither the legal authority nor the political appetite to step in and stabilize crypto markets.

Any hopes of taxpayer-backed support, he said, are misplaced.

Try Our Recommended Crypto Exchanges

Sponsored

Disclosure

We sometimes use affiliate links in our content, when clicking on those we might receive a commission at no extra cost to you. By using this website you agree to our terms and conditions and privacy policy.

No Bailout for Bitcoin

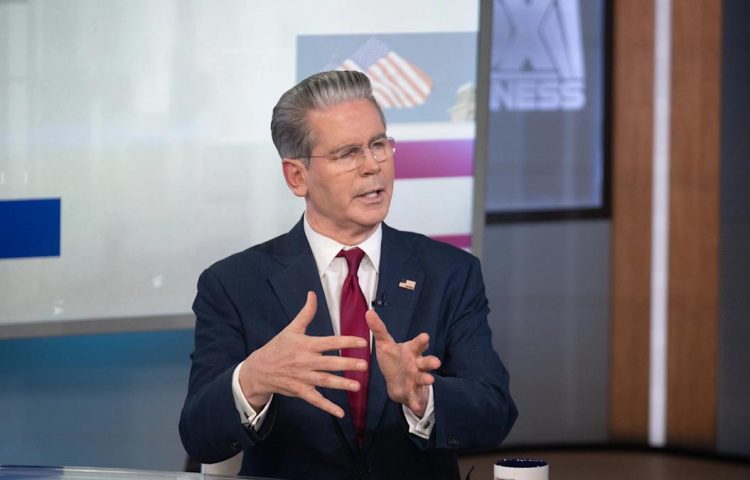

U.S. Treasury Secretary Scott Bessent delivered a stark message to cryptocurrency investors during a House Financial Services Committee hearing on February 4.

He emphasized that the federal government has no plans or authority to provide a bailout for Bitcoin amid its ongoing price decline.

In a heated exchange with Congressman Brad Sherman, Bessent addressed concerns about potential government intervention in the crypto market, particularly as Bitcoin continued to plunge to new lows.

When pressed by Sherman on whether the Treasury Department has the authority to “bail out” Bitcoin—such as by directing banks to purchase the cryptocurrency or using taxpayer funds to stabilize its price—Bessent was unequivocal:

“I do not have the authority to do that, and as chair of FSOC [Financial Stability Oversight Council], I do not have that authority,” he stated firmly.

The Secretary elaborated on the government’s current holdings of Bitcoin, primarily acquired through asset forfeitures from criminal activities.

He revealed that Bitcoin seized years ago, initially valued at around $500 million, has appreciated significantly to between $15 billion and $20 billion at current prices.

Bessent reiterated the policy outlined in a 2025 executive order signed by President Trump, which prohibits the sale of these seized assets and allows them to be added to a national digital asset reserve once legal processes are complete.

“The policy of this government is to add seized Bitcoin to our digital asset reserve after the damages are done,” Bessent explained.

He stressed that the government will acquire future Bitcoin only through ‘budget-neutral’ methods, such as forfeitures, rather than through open-market purchases using public funds.

This response underscored the administration’s hands-off approach, signaling that there would be no “safety net” for crypto investors facing losses.

Trump Administration Dials Back Bitcoin Hype

Bessent’s testimony marked a clear break from 2025, when the idea of a strategic Bitcoin reserve gained traction among crypto advocates.

He emphasized that while the U.S. would retain—and could potentially expand—its Bitcoin holdings through non-taxpayer means, the government would not step in to support prices during market downturns.

“I am Secretary of the Treasury. I do not have the authority to do that,” Bessent said, responding to questions about whether he could direct private banks to buy Bitcoin.

He flatly rejected the idea, stressing that neither his role nor the FSOC mandate allows for actions that could amount to using financial institutions to artificially prop up the market.

Bessent also addressed broader crypto policy, pointing to the government’s push for regulatory clarity around stablecoins through the GENIUS Act, signed into law in 2025.

The legislation aims to strengthen the dollar’s global reserve status through digital innovation.

Still, he cautioned that assets like Bitcoin carry inherent risks and that investment decisions—and losses—rest squarely with market participants.

This firm “no bailout” stance was reinforced by his dismissal of using Treasury resources for direct Bitcoin purchases, underscoring the government’s view of Bitcoin as a speculative asset rather than a pillar of critical financial infrastructure.

The testimony drew mixed reactions from the crypto community.

Critics argued that simply holding seized assets without active accumulation falls short of a true strategic reserve, while others welcomed the clarity as a signal that Washington will not distort markets.

BTC’s Dismal Performance

The timing of Bessent’s remarks couldn’t have been worse for bulls.

Bitcoin plunged below $70,000 on Feb. 5, marking its lowest level since November 2024 and extending a sharp reversal from January highs.

The cryptocurrency closed the day at $70,177, down from an opening price above $73,000, with intraday lows nearing $70,090.

So far in 2026, Bitcoin is down roughly 16%, wiping out late-2025 gains and fueling renewed fears of a prolonged bear market.

Selling pressure intensified in early February as Bitcoin broke below key technical support levels.

Just days earlier, it had been trading near $78,600. By Feb. 5, market capitalization had fallen more than 12% to approximately $2.7 trillion.

Multiple forces are driving the downturn.

Rising geopolitical tensions, uncertainty around U.S. trade policy, and broader risk-off sentiment have rattled high-volatility assets.

Weakness in AI and tech stocks spilled into crypto markets, while whale profit-taking and lingering ETF outflows added further strain.

Although modest ETF inflows of $560 million were recorded on February 2, they proved insufficient to halt the slide.

Top Picks for Bitcoin