This post was originally published on this site.

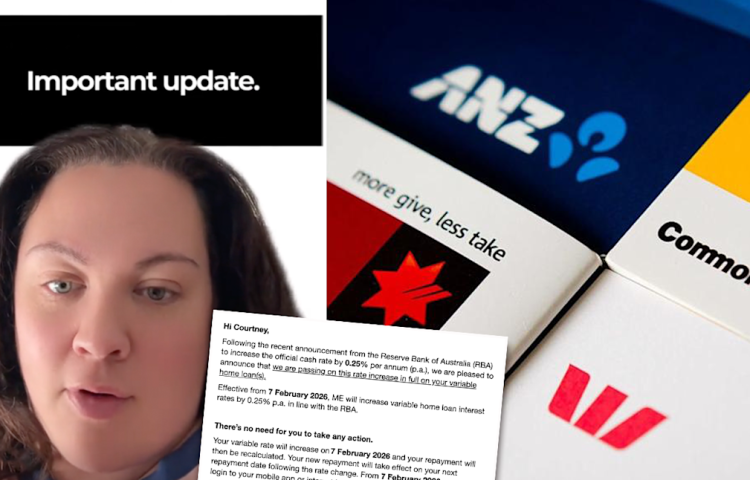

An Australian bank has apologised to its customers after telling them it was “pleased” to swiftly pass on the RBA’s latest rate hike this week. ME Bank is among the quickest lenders to pass on the interest rake hike, with customers to start incurring the higher level of interest from Saturday.

Understandably, most customers did not welcome the news. A sentiment that the was perhaps compounded by the bank’s cheery tone and apparent delight.

While a rate hike was widely predicted by the market and economists, ME Bank’s team apparently weren’t quite as prepared, seemingly using the same correspondence from the previous rate cuts last year.

On Wednesday night shortly after 9pm, the bank again emailed customers saying it was “really sorry” about the correspondence and any confusion it caused.

RELATED

“This email was sent in error, and does not reflect ME’s commitment to communicate to you with clarity and empathy.

“We understand that rates increases can be challenging, and we’re here to support you.”

The mea culpa came five hours after the bank’s initial correspondence, with plenty of customers taking to social media to poke fun at the gaffe, with some even claiming it was enough for them to think about switching lenders.

Yahoo Finance contacted ME Bank to ask about the error.

Most major lenders will not start charging the higher level of interest until late next week, or the week after, according to an extensive roundup from consumer group Finder.

ME Bank customers will be among the earliest to be subject to the higher rate when it takes effect from Saturday, February 7.

Borrowers with BOQ, which owns ME Bank, will be hit from tomorrow, February 6.

ING Bank customers will be effected from Tuesday, February 10.

ANZ, Commonwealth Bank and NAB customers will be impacted from Friday, February 13. The same day as Bankwest and Suncorp customers.

Westpac borrowers will see their interest increased a few days later on February 17. Some of the other subsidiaries of the Big Four lenders will also pass it on that day, including St George, Bank of Melbourne and Bank SA. It’s the same date for Teachers Mutual and Uni Bank.

Meanwhile Macquarie Bank will pass it on from February 20.

A majority of mortgage borrowers didn’t reduce their payments after the recent rate cuts, so the RBA’s move this week might not cool the economy to the degree it wants. For that reason, forecasters are predicting further rate hikes to come for borrowers this year.