This post was originally published on this site.

Bitcoin just fell to its lowest level in almost a year.

Bitcoin (BTC 4.02%) is the world’s largest cryptocurrency. In fact, its $1.6 trillion market capitalization accounts for more than half the value of the entire industry, which is about $2.7 trillion as I write this.

Bitcoin hit a record high of more than $126,000 last October, but it has since suffered a brutal decline of roughly 40% as investors cash in gains, and slash their exposure to highly speculative assets amid rising economic and political upheaval.

However, volatility has been a normal part of the Bitcoin investing experience since it was established in 2009. The cryptocurrency has suffered two peak-to-trough crashes of at least 70% during the past 10 years alone, and yet it recovered to make a new record high on both occasions. With that in mind, should investors use the latest dip as a buying opportunity?

Image source: Getty Images.

The case for owning Bitcoin

Bitcoin is a unique asset. It can’t be controlled by any person, company, or government because it’s fully decentralized, and it has a capped supply of 21 million coins, which creates the perception of scarcity. It is also built on a highly secure, transparent system of record called the blockchain, and transparency is a confidence booster for investors.

But despite launching 17 years ago, Bitcoin continues to struggle with its identity. Some investors feel it has the potential to transform the entire financial system, while others believe it’s a legitimate store of value and liken it to digital gold. Plenty of pundits also believe the cryptocurrency is nothing more than a plaything for speculators, which is doomed to eventually fail.

Nevertheless, one thing is clear: Bitcoin has outperformed practically every other asset during the past decade with an eye-popping 20,810% return. It left real estate, the stock market, and even actual gold in the dust.

Bitcoin Price data by YCharts

But in my opinion, the case for owning Bitcoin continues to narrow, which will make the path to further upside increasingly challenging. For example, there is no evidence to support the argument that Bitcoin will become a global currency, given the lack of adoption so far. According to crypto directory Cryptwerk, just 6,714 businesses are willing to accept it as payment, which is a drop in the bucket compared to the 359 million registered businesses worldwide.

Even long-term Bitcoin bull Cathie Wood has doubts. In an interview with CNBC last November, she reduced her 2030 price target from $1.5 million per coin to $1.2 million per coin because stablecoins are quickly snatching the crypto payments industry away from Bitcoin. Stablecoins offer practically zero volatility, so they are more suitable for sending money around the world.

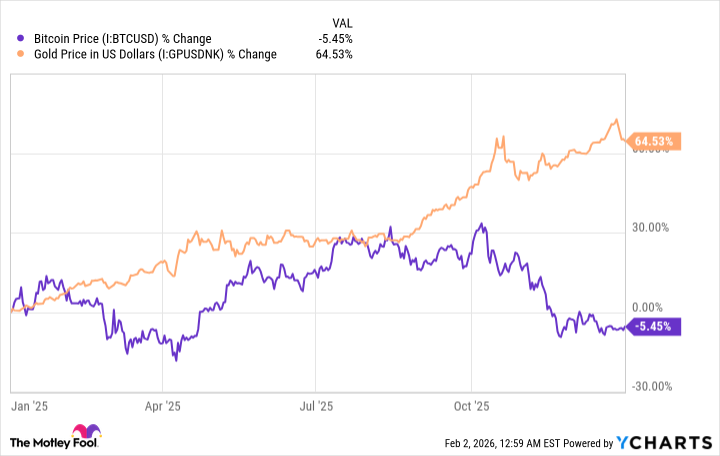

The argument that Bitcoin is a digital version of gold is also falling apart. Last year, with political and economic turmoil reaching fever pitch, gold delivered a whopping 64% return, whereas Bitcoin declined by 5%.

Bitcoin Price data by YCharts

To put it bluntly, when fearful investors were looking for a safe asset for their money, they abandoned Bitcoin and flocked to gold, which has been a proven store of value for thousands of years.

History says buy the dip, but be cautious

Investors who bought practically any Bitcoin dip since 2009 eventually ended up in the green, even if they didn’t precisely pick the bottom. From that perspective, it might make sense for investors to start building a small position, as long as they are willing to hold the cryptocurrency for several years to maximize their chances of earning a positive return.

However, if this decline turns out to be similar to the decline between 2017 and 2018 and the one between 2021 and 2022, Bitcoin might not bottom until it has lost 70% to 80% of its peak value. That means it could trade as low as $25,000 per coin in the near future, so investors need to have a stomach for volatility to ride this roller coaster.

Today’s Change

(-4.02%) $-3143.23

Current Price

$75125.00

Key Data Points

Market Cap

$1.5T

Day’s Range

$73112.00 – $78318.00

52wk Range

$73111.91 – $126079.89

Volume

77B

I’m not necessarily predicting that outcome because Bitcoin continues to attract hordes of new investors, including many institutions, thanks to the widespread availability of Bitcoin exchange-traded funds (ETFs). Many of these investors have been waiting for an opportunity to buy Bitcoin at a discount, so I expect lots of dip-buying activity.

On the flip side, Bitcoin’s price action last year is likely making many believers nervous — especially those who were holding it as an alternative to gold, because I think that narrative is officially busted.

Although it’s impossible to predict the direction of such a speculative asset, investors who think Bitcoin will eventually recover from its recent dip have history on their side. However, take a long-term view, and keep position sizing small to keep the potential risks in check.