This post was originally published on this site.

Make better investment decisions with Simply Wall St’s easy, visual tools that give you a competitive edge.

-

Morgan Stanley (NYSE:MS) co president Daniel A. Simkowitz recently sold company stock, drawing attention to executive activity at the bank.

-

The firm’s Chief Investment Officer is separately outlining views on multiyear shifts in global trade and investment patterns under the Trump administration.

-

Together, the insider sale and public commentary are giving investors fresh information on how Morgan Stanley’s leadership is thinking about risk, capital allocation and global opportunity.

Morgan Stanley, a global financial services firm, is deeply tied to cross border capital flows through its investment banking, wealth management and trading businesses. When senior leaders adjust their personal holdings or speak publicly about trade realignment, it can give you extra context on how the firm is positioned across regions and asset classes. These signals sit alongside the usual earnings reports and regulatory filings that investors watch.

For you as a shareholder or prospective investor, a key question is how leadership views long term shifts in supply chains, tariffs and capital flows, and what that might mean for Morgan Stanley’s mix of clients and revenue streams. The combination of insider activity and high level trade commentary can help you assess how the firm may be preparing for a potentially different pattern of global growth, sector exposure and deal activity over the coming years.

Stay updated on the most important news stories for Morgan Stanley by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Morgan Stanley.

Why Morgan Stanley could be great value

The insider sale by co president Daniel A. Simkowitz adds a fresh reference point on leadership sentiment at the same time Morgan Stanley is very active in the bond market, issuing a mix of fixed and variable rate notes out to 2037. For you, that pairing of personal share sales and ongoing funding activity can be a cue to look at how the bank is managing its own capital structure while senior figures are talking publicly about multi year shifts in trade, interest rates and deal flow.

The existing narratives around Morgan Stanley focus on recurring wealth management fees, technology investment and buybacks on one side, and competitive, regulatory and integration risks on the other. Executives highlighting global trade reconfiguration, while the firm raises billions through new notes and participates in large fixed income offerings, ties directly into those storylines about broadening international reach and keeping enough balance sheet flexibility to respond to client demand, similar to peers like Goldman Sachs and JPMorgan Chase.

-

Insider selling over the past 3 months, including Simkowitz’s US$6m sale, is flagged as a risk and may lead some investors to question how leadership views upside from current levels.

-

The dividend is flagged as not well covered by free cash flows, so additional debt issuance is worth watching in case it adds to payout pressure in tougher conditions.

-

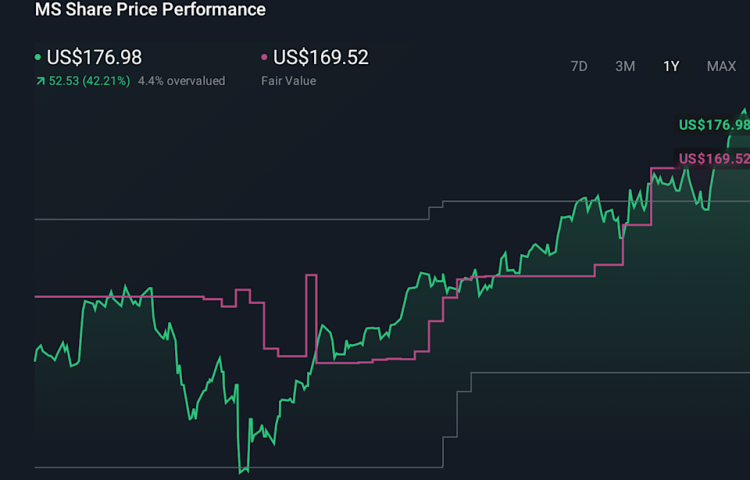

Analysts highlight that Morgan Stanley trades at a P/E below the broader US market and see it as good value relative to peers, with earnings having grown 26.9% over the past year.

-

Earnings are forecast to grow 5.41% per year, which, combined with active funding and global trade commentary, suggests leadership is positioning for continued revenue opportunities across regions.

From here, it is worth tracking any further insider transactions, how frequently Morgan Stanley taps bond markets, and whether leadership trade commentary translates into shifts in revenue mix versus competitors such as Bank of America and Citigroup. If you want to see how these pieces fit into longer term stories and different valuation views, check community narratives on the dedicated Morgan Stanley page, where you can read a range of bullish, bearish and consensus takes in one place.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include MS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com