This post was originally published on this site.

Novo Nordisk just introduced a GLP-1 pill, but the company makes more than just weight-loss drugs.

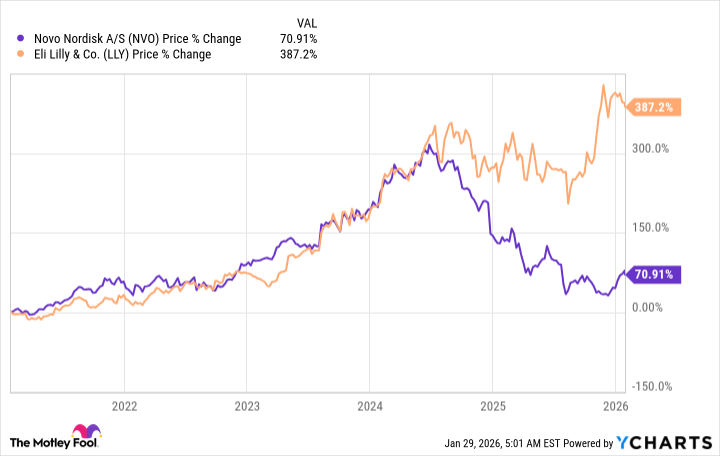

The big story in the pharmaceutical sector has been the emergence of GLP-1 weight-loss drugs. Novo Nordisk (NVO 0.60%) was an early leader in the space. However, Eli Lilly‘s (LLY +0.47%) GLP-1 version quickly surpassed it, prompting some on Wall Street to dump Novo Nordisk and buy Eli Lilly. But Novo Nordisk could be the better bargain if you think long-term.

Wall Street likes a good story

Investors can be pretty irrational over short periods, often rushing like lemmings into hot stocks. That’s what appears to be happening among investors buying GLP-1 stocks today.

Image source: Getty Images.

When Novo Nordisk introduced Ozempic to the world, investors jumped on board, recognizing the significant impact this diabetes drug could have on patients seeking help with weight-loss. It began marketing a drug, Wegovy, specifically to help with weight loss. When Eli Lilly’s GLP-1 variation, Mounjaro (for diabetes) and Zepbound (for weight loss), proved more attractive to patients, Novo Nordisk’s stock tanked, while Eli Lilly’s rose.

Data by YCharts.

There’s really nothing shocking in any of this. Wall Street operates like this all the time. Yet there are implications to consider when stocks move up and down in dramatic fashion.

One of the biggest considerations is valuation, which is more art than science. But the effect of the different price moves here has been pretty clear.

Eli Lilly’s price-to-earnings ratio (P/E) is a lofty 50, while Novo Nordisk’s is around 18. Lilly’s P/E is currently below its five-year average of 55, but Novo Nordisk’s five-year average P/E is 30. All in, the latter is cheaper on both an absolute basis and relative to its own history. Novo Nordisk is offering a generous 2.8% dividend yield versus a miserly 0.6% yield for Eli Lilly.

Novo Nordisk isn’t just a GLP-1 maker

To be fair, you could argue that Novo Nordisk isn’t the leader in the GLP-1 space. That’s true, but it is still an innovative pharmaceutical company.

For example, it was the first to market with a GLP-1 pill. Given that consumers generally prefer pills over injections, it has a chance to regain some market share from Eli Lilly, which is working on a pill, too, so this isn’t a long-term benefit.

All this speaks to the competitive nature of the drug sector. Eli Lilly isn’t going to be on top forever. Notably, Pfizer (PFE 0.02%) is working on its own GLP-1 drug lineup, using acquisitions and partnerships in an effort to speed up its product development.

Novo Nordisk

Today’s Change

(-0.60%) $-0.35

Current Price

$59.08

Key Data Points

Market Cap

$200B

Day’s Range

$57.79 – $59.30

52wk Range

$43.08 – $93.80

Volume

690K

Avg Vol

21M

Gross Margin

81.93%

Dividend Yield

2.91%

Which is why you might want to buy Novo Nordisk at a bargain price. However, the real key is that it makes more than just GLP-1 drugs.

It is also a leader in the diabetes space more generally. While GLP-1 drugs are beneficial for diabetics, the company’s historical strength is in the production and sale of insulin. The ongoing need for insulin creates repeat customers, which, in turn, makes this business a reliable cash flow generator.

In fact, the dividend payout ratio is a very comfortable 40% or so, thanks to the robust business hidden behind the GLP-1 story. That low a payout ratio suggests that the high yield here is very secure.

A bargain likely worth owning

Novo Nordisk has leaped ahead on the innovation front with its GLP-1 pill, but that isn’t the big reason to like the stock. If you are a dividend investor or prefer to err on the side of value, the stock should look attractive to you right now. The innovation side of things will ebb and flow, but Novo Nordisk’s core diabetes business remains a solid foundation for both the dividend and the company’s long-term growth.