This post was originally published on this site.

Additional analysis by Karim Abdelmawla

Recent market weakness reflects shock-driven repricing and policy uncertainty rather than a breakdown in Bitcoin’s structural thesis. A cluster of geopolitical events and regulatory overhang triggered short-term risk-off moves, but Bitcoin has absorbed stress better than the broader crypto market.

While volatility remains elevated, price action and flows suggest temporary turbulence within an intact long-term uptrend. While price has been fairly muted, Bitcoin’s adoption during geopolitical shocks increasingly resembles that of a non-sovereign, scarce asset during periods of global instability, while regulatory uncertainty continues to cap upside for most altcoins and decentralized finance (DeFi).

The return to value investing is clear as high-quality digital assets outside Bitcoin with robust fundamentals outperformed, such as Hyperliquid and Canton, up ~30% year to date. The next growth wave in digital assets will revolve around consumer-facing products. Platforms like Polymarket now exceeding $800 million in weekly volume signal that end-user adoption may begin to outpace infrastructure expansion.

What happened in January?

January started with a series of geopolitical shocks and policy delays that simultaneously tested global risk appetite and DeFi infrastructure. Bitcoin briefly sold off alongside broader risk assets, retesting key support levels, before stabilizing near monthly lows.

- Bitcoin briefly retraced from the mid-$90,000s toward the $85,000–$88,000 range.

- Volatility was amplified by relatively thin liquidity windows, particularly over weekends. In fact, volatility over the weekend was 148% higher than the average over the weekdays. This is further amplified by the fact that trading volume on weekends is roughly 70% lower than during the week.

Importantly, this weakness unfolded against a backdrop of rising geopolitical fragmentation and delayed regulatory clarity in the US, rather than deteriorating top-line growth of digital assets.

There are 5 reasons for the drawdown

1) Geopolitical shocks

The US’s capture of Venezuelan President Nicolás Maduro triggered immediate volatility across energy and digital asset markets. While the event reinforced the long-term de-dollarization trend, it initially pushed markets into a risk-off posture, which we covered in greater detail earlier this month.

2) Iranian instability and currency collapse

Escalating protests, internet blackouts, and the Iranian Rial (IRR) collapsing against the US dollar by over 90%, drove Bitcoin up more than 2,000% against the IRR, briefly nearing 10 billion IRR per BTC. While this had a limited impact on global asset pricing, it reinforced Bitcoin’s role as a non-sovereign financial rail under capital controls and banking stress.

3) Policy uncertainty and regulatory vacuum

The postponement of the CLARITY Act, combined with growing concern over a potential US government shutdown, weighed heavily on investor confidence. With traditional markets closed over the weekend, crypto markets absorbed the full impact of this uncertainty, driving a sharp but contained correction.

4) Trade policy threats and liquidity effects

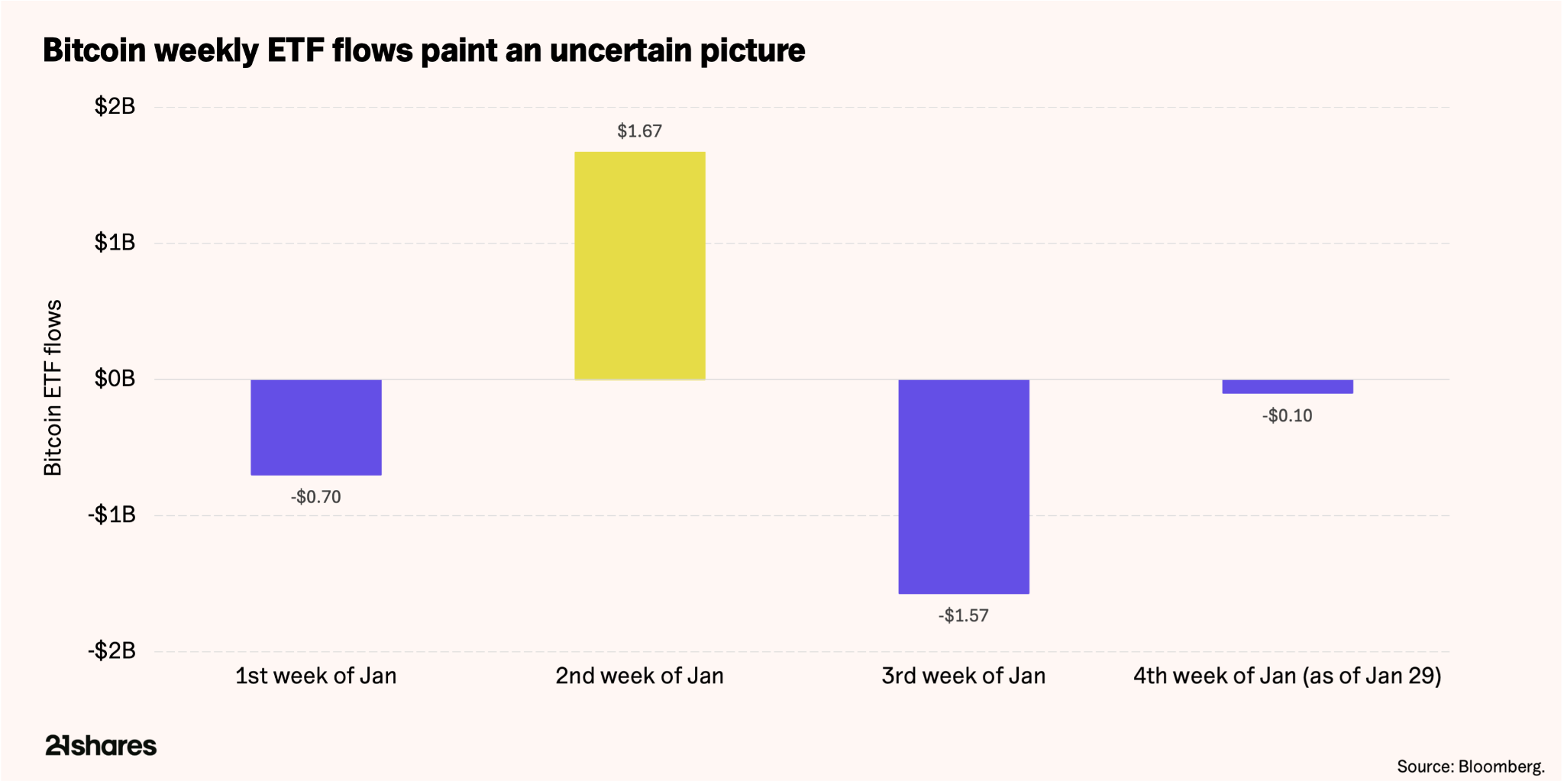

President Trump’s threat of a 10% tariff on several European nations tied to Greenland negotiations triggered over $1 billion in Bitcoin ETF weekly outflows. Once a framework deal was announced and tariffs were lifted, prices partially recovered, highlighting the move’s transient nature.

5) Altcoin fragility

Regulatory ambiguity continues to suppress risk appetite outside Bitcoin. Altcoin market capitalization remains pinned between $800 billion and $1 trillion, reflecting constrained institutional participation and limited risk tolerance.

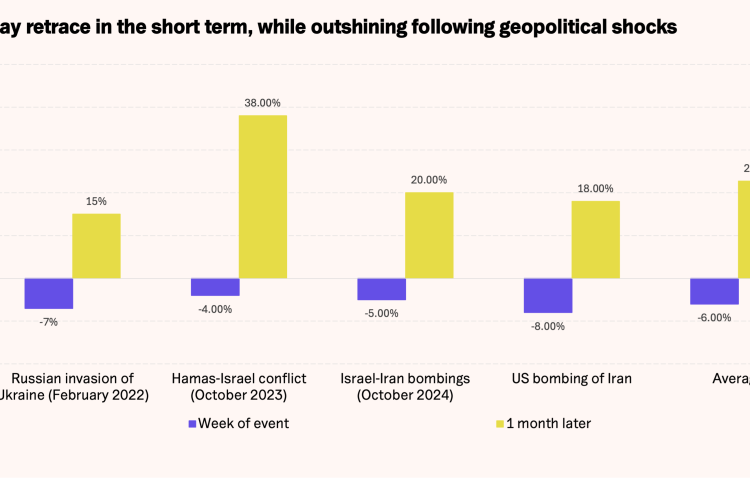

Historically, similar geopolitical shocks have resulted in 4-8% drawdowns within 48 hours, followed by rebounds averaging ~22.75% within 30 days, suggesting January’s move fits a familiar corrective pattern rather than a regime shift.

Technical levels on our radar

- $85,000 – $86,000: Key downside support tested during peak policy uncertainty.

- $88,000: Monthly support level where price stabilized.

- $95,000 – $98,000: Prior resistance zone reached following the Venezuela shock.

While short-term momentum remains fragile, price behavior has respected major structural levels so far. A sustained breakdown below support level would warrant reassessment, but current action appears corrective rather than structural.

What are markets telling us?

Sentiment: Fear & Greed at 35 (“Fear”) reflects caution but not capitulation, historically consistent with consolidation rather than prolonged bear markets. And while sentiment may seem low now, we actually spent most of the month in “Extreme Fear”, even reaching a score of 20 – echoing the lows of the FTX collapse.

Derivatives positioning: Long and short positioning remains roughly balanced (~50/50), suggesting uncertainty rather than excessive leverage or forced deleveraging.

ETF flows: Outflows of roughly $1 billion were driven by short-lived policy and tariff concerns linked to Greenland, before stabilizing. Net Bitcoin ETF flows finished the month at around -$700 million, consistent with event-driven positioning rather than structural outflows.

Overall, market signals point to hesitation and consolidation, not systemic stress.

Silver linings and fundamentals to watch

The CLARITY Act remains the most important medium-term catalyst for the crypto market outside of Bitcoin. Its goal is straightforward: define what constitutes a commodity versus a security and clarify regulatory jurisdiction across digital assets in the US.

The January postponement followed late-stage Senate revisions that prompted Coinbase to withdraw support. These changes would have restricted tokenized securities, expanded KYC/AML obligations to decentralized protocols, and limited stablecoin yield distribution, reintroducing uncertainty just as markets were pricing in progress.

The delay reinforced a two-speed market: Bitcoin is insulated, while regulatory uncertainty continues to suppress flows to long-tail digital assets. A market-friendly CLARITY Act could unlock capital allocation to altcoins; without it, institutional exposure remains concentrated in Bitcoin.

Turning quantum anxiety into action

Quantum computing is an emerging form of computing that uses quantum bits (qubits), which can process many possibilities at once, making certain calculations far faster than today’s computers.

The concern for crypto is that blockchain security relies on cryptography that is nearly impossible for classical machines to break. Powerful future quantum computers could potentially solve these mathematical problems more efficiently, exposing private keys or weakening digital signatures. This is not an immediate threat, but because blockchains secure long-term value, the industry must begin transitioning toward post-quantum cryptographic protections well in advance.

As awareness of this long-term risk grows, the focus is shifting from speculation to preparation. The industry has elevated the threat to a top priority through concrete initiatives like the Coinbase Independent Advisory Board on Quantum Computing and Blockchain, the Ethereum Foundation’s new post-quantum security unit, and Project Eleven’s recent $20 million Series A to harden digital infrastructure against future vulnerabilities.

Institutional adoption continues

Despite price volatility, institutional engagement accelerated:

- UBS Wealth Management announced plans to offer direct BTC and ETH trading.

- Interactive Brokers launched 24/7 account funding via USDC.

- BitGo’s IPO was oversubscribed 13x, the strongest listing of the year so far.

- Nasdaq joined the Canton Network as a Super Validator for tokenized real-world assets.

Monetary policy optionality: Bitcoin has spent 71% of its history in a low-interest rate environment below today’s 3.50%–3.75%. Any dovish shift at the upcoming FOMC meetings would materially improve liquidity conditions.

Bitcoin, the gold catch-up trade: Gold’s ~30% gain over three months historically precedes Bitcoin outperformance by 3–6 months, as seen in 2018 and 2020.

BULL VS. BEAR SCENARIOS

Bull case (60%)

- Regulatory clarity improves with concrete timelines.

- Monetary policy turns incrementally more dovish.

- Bitcoin resumes its role as a geopolitical hedge, reclaiming prior highs.

- Capital remains concentrated in BTC, with selective rotation into high-quality long tail assets with strong fundamentals.

- Geopolitical tensions ease.

Bear case (40%)

- Regulatory delays persist, and policy uncertainty lingers.

- Liquidity conditions remain restrictive, especially within the context of the Japanese economy (see August 2024).

- Bitcoin consolidates for longer, below 20%, from the previous all-time high of ~$126,000, with altcoins remaining suppressed.

Shock-driven repricing and policy uncertainty, not structural weakness

Bitcoin continues to demonstrate resilience amid geopolitical stress, further validating its role as a non-sovereign reserve asset. Outperforming Bitcoin, high-quality digital assets with robust fundamentals, such as Hyperliquid and Canton, are up by ~30% year to date.

As long as regulatory uncertainty persists, Bitcoin remains the default institutional exposure within crypto. Fear-driven volatility may feel uncomfortable, but historically it has laid the groundwork for the next phase of upside once policy and liquidity conditions stabilize.