This post was originally published on this site.

January 29, 2026

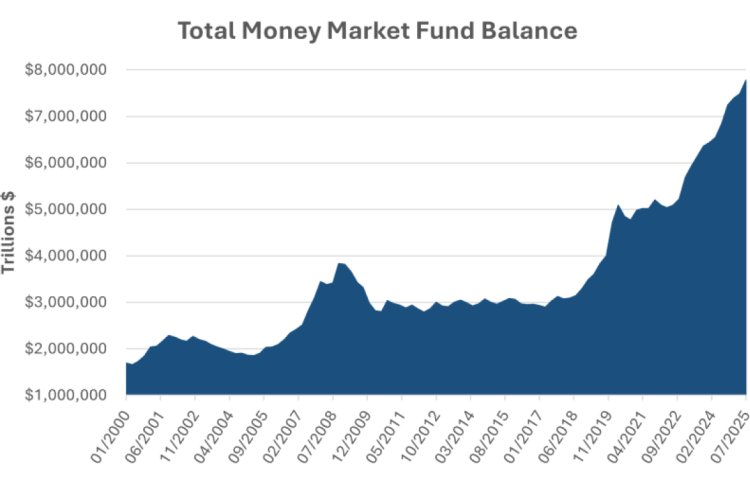

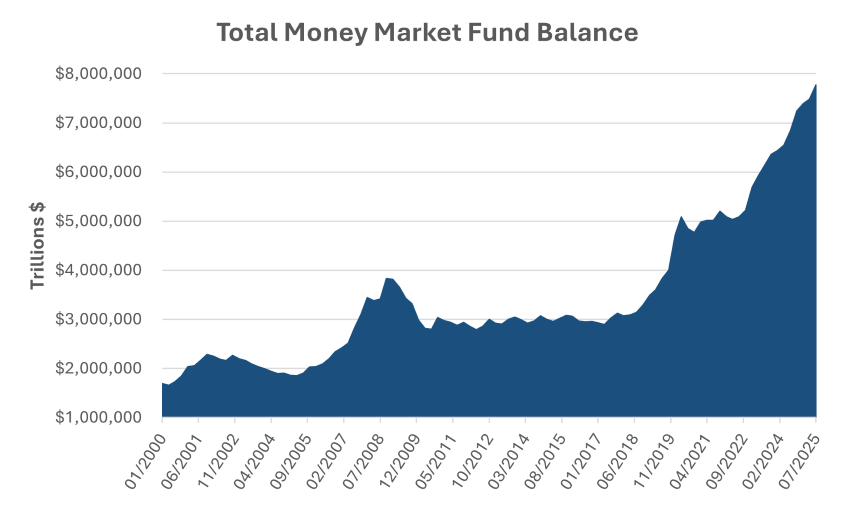

U.S. money market funds have experienced substantial growth in assets under management over recent decades, driven by shifting interest rate environments, economic disruptions, regulatory reforms and sustained investor demand for safe, liquid cash alternatives. Total balances remain exceptionally elevated—recently reaching approximately $7.8 trillion1—despite the Federal Reserve (Fed) beginning an easing cycle in late 2025.

Since its peak above 5%, the Fed has reduced the target federal funds rate to a range of 3.50%-3.75%, a move that directly lowers yields on money market funds. At first glance, this persistence of elevated cash balances may seem counterintuitive, as declining rates have historically encouraged investors to rotate out of cash and into higher-returning assets such as equities or longer-duration fixed income. However, current conditions help explain why money market funds continue to attract significant capital.

Even with rates trending downward, money market funds continue to offer attractive yields relative to traditional bank deposits, often outpacing insured savings accounts by a meaningful margin. On a historical basis, yields remain appealing, and both institutional and retail investors maintain money market allocations to meet liquidity needs, satisfy short-term operating requirements or utilize as a temporary parking place for capital. Because these funds invest primarily in short-dated instruments such as Treasury bills, agency discount notes and high-quality commercial paper, their yields reset gradually, providing a smoother descent compared to more volatile market instruments.

As a result, the combination of still-competitive yields in money markets, principal stability, daily liquidity and limited confidence in the broader economic outlook has kept balances near record highs rather than prompting a meaningful rotation into risk assets. An elevated money market fund balance may reflect continued investor caution amid slowing growth, uncertain inflation dynamics and relatively full valuations across other asset classes.

Key Takeaway

While balances remain near record highs, catalysts such as a steeper yield curve, clearer economic outlook or a more aggressive Fed easing trajectory could prompt reallocations toward longer-duration fixed-income sectors. Until these alternative asset classes offer meaningfully better risk-adjusted returns, or the economic outlook becomes clearer, money market funds are likely to remain a central destination for investor capital.

Sources:

1Federal Reserve Bank of St. Louis

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.